Afghanistan Crypto Crackdown Timeline

Explore the key enforcement actions against crypto activities in Afghanistan from June 2022 through September 2023. The timeline shows how the Taliban's approach evolved from vague warnings to mass arrests and exchange closures.

Central Bank Ban Announced

Taliban-run central bank issued a ban on crypto trading, citing Islamic law arguments about gambling and uncertainty. The decree was vague, targeting "online foreign-exchange trading" without naming specific cryptocurrencies.

Details

The announcement created uncertainty but traders continued operations, arguing the ban applied only to illegal forex platforms.

Herat Crackdown Begins

Police in Herat shut down more than 20 crypto-related businesses, marking the first mass enforcement actions against digital currency activities.

Details

Herat, a key border city with Iran, became the initial enforcement zone, targeting local crypto businesses.

First Mass Arrests

Eight traders were detained for 28 days and faced possible six-month sentences, signaling a shift from business closures to criminal charges.

Details

This represented a significant escalation, moving from warnings to tangible legal consequences for individuals.

Peak Enforcement

Police chief announced closure of 16 exchanges in Herat and arrest of 13 people. This marked the most intensive crackdown to date.

Details

Most of those arrested were later released on bail, but the actions demonstrated the Taliban's commitment to enforcement.

Underground Shift

Crypto activity has shifted to more discreet peer-to-peer methods and privacy-focused wallets, though exact volumes are difficult to track.

Details

The number of active exchanges fell from 40-50 at the 2021 peak to fewer than a dozen by late 2023. This underground market carries increased risks for users.

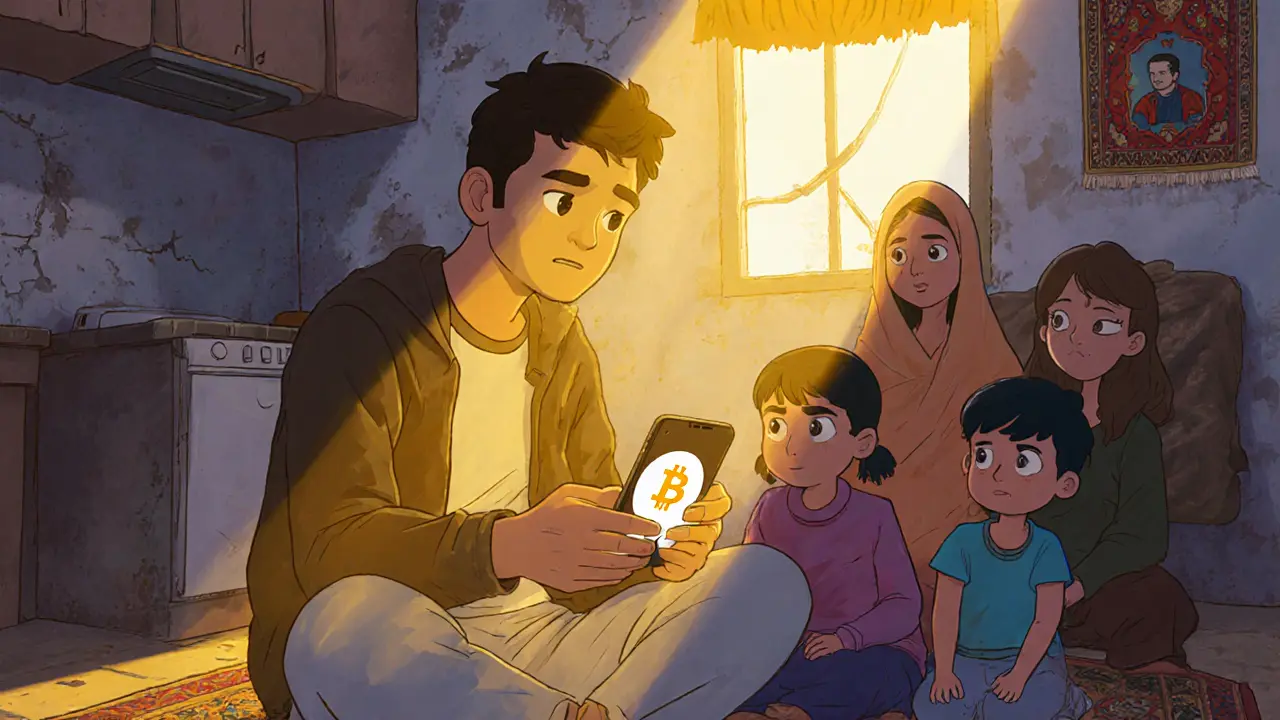

Key Insight: The Taliban's enforcement shifted from vague warnings to concrete actions, but the crackdown has significantly impacted ordinary Afghans who rely on crypto for basic survival. With banks isolated, cryptocurrency remains the primary lifeline for families receiving international remittances.

Afghanistan crypto crackdown is the term analysts use to describe the Taliban’s sweeping crackdown on digital‑currency activities that began in mid‑2022. The campaign has shut down dozens of exchanges, led to dozens of arrests, and pushed ordinary Afghans who relied on crypto for basic survival into a legal gray area.

Why crypto exploded after the Taliban takeover

When the Taliban seized Kabul in August 2021, the formal banking system froze almost overnight. International sanctions cut off the already fragile financial links, and families that depended on overseas remittances suddenly found no way to get money home.

Digital assets stepped in as a lifeline. Chainalysis ranking placed Afghanistan 20th worldwide for grassroots crypto adoption, with on‑chain values topping $962 million between July 2020 and June 2021. Most of that volume came from peer‑to‑peer Bitcoin trades and USDT transfers that bypassed banks.

People weren’t just speculating; they were sending food money from relatives in Europe and the United States. NGOs even piloted crypto‑based food vouchers, and a women‑empowerment project used weekly USDT payments to keep families fed.

The Taliban’s first move: a ban that felt vague

In June 2022 the Taliban‑run central bank announced an outright ban on crypto trading. Officials claimed the move was rooted in Islamic law, arguing that the uncertainty (gharar) in digital assets equated to gambling. A central‑bank spokesman told Bloomberg there was “no instruction in Islamic law to approve it.”

However, the decree was ambiguous. It spoke of “online foreign‑exchange trading” without naming Bitcoin, Ethereum, or stablecoins. Early on, traders argued the ban only covered illegal forex platforms, not the crypto wallets they already used for family remittances.

Escalation: from warnings to arrests

By late 2022 the Taliban shifted from vague warnings to hard enforcement. In August 2022, police in Herat-a key border city with Iran-shut down more than 20 crypto‑related businesses, according to the Strait Times. The crackdown intensified in May 2023 when eight traders were detained for 28 days and faced possible six‑month sentences.

September 2023 marked the peak of the campaign. Police chief Sayed Shah Sa’adat announced the closure of 16 exchanges in Herat and the arrest of staff members. Ariana News reported that 13 people were taken into custody, though most were later released on bail.

These actions form a clear timeline:

| Month/Year | Action | Impact |

|---|---|---|

| June 2022 | Central bank issues crypto ban | Legal ambiguity, traders continue |

| August 2022 | Herat police shut >20 businesses | First mass closures |

| May 2023 | 8 traders arrested, 28‑day detention | Potential 6‑month sentences |

| September 2023 | 16 exchanges closed, 13 arrests | Broad crackdown across Herat |

Human faces behind the numbers

Behind every closed exchange is a family that now struggles to put food on the table. One trader told Coinspeaker he used to make 1‑2 % margins on USDT trades, but after the ban he “could no longer afford to feed his family.” Another Afghani, whose brother lives in the U.S., said his household survives on Bitcoin and USDT remittances and that without crypto “there’s no other way.”

UNICEF warned in 2023 that more than one million Afghan children faced severe malnutrition. When crypto channels disappear, the flow of remittances-often the only source of cash for purchase of food and medicine-shrinks dramatically.

Even NGOs have felt the pinch. The World Bank reported in April 2023 that 97 % of Afghans lived below the poverty line. With banks sealed off, crypto was the last financial bridge. The crackdown therefore compounds an already dire humanitarian crisis.

What the Taliban says: religious, fraud, and security concerns

Taliban officials frame the ban as a protection measure. In June 2022 a spokesman declared digital‑currency trading “illegal and fraudulent,” citing the lack of Islamic legal sanction. In press statements, Sayed Shah Sa’adat claimed that crypto “caused a lot of problems and is scamming people.”

Security arguments also appear. The 2025 TRM Labs Crypto Crime Report flagged growing crypto usage by the Islamic State Khorasan Province (ISKP), noting hundreds of transactions ranging from $100 to $15 000 that funded attacks, including a March 2024 Moscow incident. While these terror‑financing links exist, most enforcement actions target ordinary traders, not the militants themselves.

Market fallout: a shift underground

Since the crackdown, on‑chain volumes from Afghanistan have dropped sharply, though exact figures are hard to capture because users have migrated to more discreet peer‑to‑peer methods and privacy‑focused wallets. The number of active exchanges fell from an estimated 40‑50 at the 2021 peak to fewer than a dozen by late 2023.

Underground activity brings its own risks. Without regulated platforms, users face higher chances of fraud, price manipulation, and exploitation by criminal middlemen. TRM Labs and Chainalysis warn that a more clandestine market could actually increase the very criminal activity the Taliban claims to curb.

International reaction and future outlook

Global observers label Afghanistan’s ban as one of the most aggressive crypto crackdowns worldwide. Yet the ban’s effectiveness is questionable. The World Bank and UNICEF stress that without a viable remittance channel, poverty and malnutrition will deepen.

Some analysts argue the Taliban will eventually have to tolerate a limited, shadow crypto ecosystem simply because the country remains financially isolated. Others predict harsher penalties if the regime feels threatened by illicit flows, especially if international sanctions tighten further.

What can be expected?

- Continued arrests in high‑traffic hubs like Herat, especially during crackdowns on “illegal” forex platforms.

- More use of privacy tools (e.g., Monero, Tails OS) as traders try to evade detection.

- Potential humanitarian exceptions, though none have been officially announced.

- Increased international advocacy calling for safe crypto corridors for aid.

For ordinary Afghans, the choice remains stark: risk legal trouble to keep families fed, or abandon crypto and fall into deeper poverty.

Quick FAQs

What triggered the Taliban’s crypto ban?

The ban was announced in June 2022 by the Taliban‑run central bank, citing religious prohibitions against gambling and uncertainty, plus concerns about fraud and loss of governmental control over money flows.

How many crypto exchanges have been closed?

By September 2023, police in Herat shut down 16 exchanges in a single sweep, and overall estimates suggest more than 30‑plus exchanges have been forced to close since 2022.

Are arrested traders having their crypto seized?

Reports conflict: some detainees say their wallets were untouched, while others claim officials seized all holdings. The lack of clear procedure fuels uncertainty.

What impact does the crackdown have on humanitarian aid?

Aid organizations that used crypto to send rapid cash assistance now face delays or cannot operate at all, worsening food insecurity for millions of children.

Will the Taliban ever lift the ban?

It’s hard to predict. Economic pressure and the need for remittances may force a pragmatic loosening, but political and security concerns could keep restrictions in place for the foreseeable future.

19 Comments

Manish Gupta

Wow, the numbers in this post really highlight how desperate people got when the banking system collapsed. It’s crazy to think that everyday families were sending Bitcoin to buy groceries 😮. The Taliban’s crackdown feels like a blunt instrument on a fragile lifeline. I keep wondering how many more will be forced into the shadows because of this ban. The whole situation is a perfect storm of politics and poverty :)

Sarah Hannay

While the analysis is thorough, it must be emphasized that any governance structure-particularly one lacking international legitimacy-has the prerogative to impose financial regulations it deems consistent with its interpretation of Sharia law. Nevertheless, the indiscriminate nature of the arrests, without clear procedural safeguards, contravenes basic principles of justice and due process. The humanitarian repercussions are stark, and any policy lacking compassionate exceptions is morally untenable. Moreover, the omission of transparent seizure protocols further exacerbates public distrust.

Prabhleen Bhatti

From a macro‑economic perspective, the crypto backlash in Afghanistan exemplifies a classic case of regulatory capture colliding with informal financial intermediation; the Taliban’s decree, though couched in religious rhetoric, effectively marginalizes a shadow banking ecosystem that had, until recently, facilitated cross‑border remittances, micro‑credit, and even humanitarian aid channels. Moreover, the ambiguous phrasing of the ban-"online foreign‑exchange trading"-creates a legal vacuum wherein actors oscillate between compliance and clandestine operation, thereby inflating transaction risk premiums; this, in turn, catalyzes the adoption of privacy‑centric protocols such as Monero and Tails OS. Consequently, the intended deterrence morphs into a feedback loop that amplifies illicit activity, undermining the very security narrative the regime propagates.

Elizabeth Mitchell

It’s a sad picture, for sure. The crackdown really pushes people into the darkness, and it feels like there’s no easy way out. I can’t help but think about those families who just want to feed their kids.

John E Owren

Exactly, the human angle matters most here. While policy debates are important, we should remember that behind every statistic is a person trying to survive.

Joseph Eckelkamp

Let me break this down for you, step by step, because the sarcasm is practically dripping from the ink. First, the Taliban decides that a decentralized financial system-something that puts power in the hands of ordinary people-is "illegal." How original. Second, they announce a vague ban that only mentions "online foreign‑exchange trading," clearly expecting everyone to read between the lines and guess whether Bitcoin is included. Third, the enforcement squad bursts into Herat, shuts down over twenty crypto‑related businesses, and walks away like they just took down a candy store because the kids were chewing gum. Fourth, eight traders are hauled off for a month‑plus, as if the threat of six‑month jail time will magically make people stop sending money home. Fifth, the September sweep closes sixteen exchanges and arrests a dozen more-because nothing says "we care about the poor" like a courtroom showdown. Sixth, the underground market blooms, sprouting privacy‑centric wallets and black‑market middlemen, which is exactly what the crackdown claimed to prevent. Seventh, NGOs, already stretched thin, now have to navigate a maze of legal uncertainties while trying to get food to starving children. Eighth, the international community watches, shaking its head, while the World Bank and UNICEF publish grim statistics about malnutrition and poverty. Ninth, the Taliban clings to its religious justification, citing "gharar" (uncertainty) and "gambling," while ignoring the fact that their own policies introduce far more uncertainty for the populace. Tenth, the narrative spins: they are protecting the nation from fraud, yet they sow fraud by driving transactions underground. Eleventh, the very people they claim to protect are now forced to choose between legal danger and starvation. Twelfth, the entire episode serves as a textbook example of policy‑by‑force rather than policy‑by‑consensus. Thirteenth, the crackdown is a micro‑cosm of how authoritarian regimes attempt to control information and money alike. Fourteenth, the result is a humanitarian crisis that no amount of religious rhetoric can fix. Fifteenth, the international community should perhaps consider a safe crypto corridor for aid-if that’s not too radical an idea. Sixteenth… well, you get the picture.

Jennifer Rosada

One must reflect on the ethical implications of imposing such draconian measures on a populace already suffering from severe deprivation. The moral responsibility of any governing body includes safeguarding the basic needs of its citizens, and restricting a vital remittance channel falls short of that duty. It is incumbent upon the international community to advocate for humanitarian exceptions that prioritize human life over ideological rigidity.

adam pop

The real story is hidden: they’re using the crypto ban as a front for a larger agenda of surveillance and control. Every crackdown like this is just a step toward a total authoritarian financial system where only state‑approved currencies survive. The danger isn’t the crypto itself, it’s the power it gives people to operate outside the regime’s watchful eye.

Dimitri Breiner

Honestly, the Taliban’s approach is short‑sighted. They’re cutting off the lifeline that the Afghan people built out of sheer necessity. If they want stability, they need to embrace solutions, not ban them outright.

LeAnn Dolly-Powell

💡 Absolutely! There’s still hope if we keep pushing for safe crypto corridors. 🌍💪

Sam Kessler

It is evident that the regulatory overreach exemplified by the Taliban’s crypto prohibition constitutes a paradigmatic failure of statecraft, wherein the ostensibly protective legislation inadvertently engenders a pernicious black market, thereby subverting the very security objectives it purports to safeguard. Such policy myopia underscores a profound disconnect between doctrinal orthodoxy and the exigencies of contemporary fiscal ecosystems.

Steve Roberts

Well, if we’re being honest, the crackdown is just another example of power being used to stifle economic freedom. It’s not about religion or fraud; it’s about keeping control.

Peter Schwalm

The data points to a clear trend: the more the authorities push, the more people adapt with underground methods. It’s a cat‑and‑mouse game at this point.

Alex Horville

We can’t let foreign influences dictate our financial sovereignty. The crackdown is a necessary stand for national integrity.

Marianne Sivertsen

From a neutral standpoint, the situation is complex. There's no easy fix, and every action has ripple effects.

Shruti rana Rana

Indeed, the ramifications are profound; the humanitarian stakes are elevated, and the socio‑economic fabric is strained-yet there remains a glimmer of resilience among the affected populace. 🌟📈

Stephanie Alya

So basically the Taliban decided crypto is bad, shut everything down, and now everybody’s stuck. Classic move.

Richard Williams

Let’s keep the conversation focused on solutions. If we can lobby for a humanitarian crypto lane, that could ease a lot of pressure.

Rohit Sreenath

The crackdown is a textbook case of misguided authority exercising power without understanding the economic realities on the ground. It’s simply incompetent.