Crypto Risk Calculator: Ecuador

This tool helps you assess your risk level when trading cryptocurrency in Ecuador based on your choices. Using regulated exchanges minimizes legal and security risks compared to underground channels.

Quick Takeaways

- Cryptocurrencies are legal to trade in Ecuador, but they are not legal tender.

- Underground trading thrives on anonymity, cash‑only deals, and peer‑to‑peer platforms that sidestep AML/KYC rules.

- Typical underground channels include informal cash brokers, darknet forums, and unregistered P2P groups.

- Risks range from fraud and loss of funds to potential legal penalties for money‑laundering violations.

- Sticking to regulated exchanges, using strong security practices, and verifying identities keep you on the safe side.

When you hear the phrase underground crypto market in Ecuador is the informal network where people trade digital assets outside regulated channels, often to avoid taxes or restrictions, you probably picture secret meet‑ups and cash‑only deals. In reality, it’s a mix of peer‑to‑peer platforms, cash‑based brokers, and sometimes darknet forums that slip under the radar of the country's financial watchdogs.

Legal Landscape in Ecuador

Ecuador clarified its stance on digital currencies in the early 2020s. While buying and selling Bitcoin, Ethereum, and dozens of other tokens is allowed, the government does not recognize any cryptocurrency as official legal tender. This means you can own and trade crypto, but you cannot use it to pay for a bus ticket or a grocery bill.

Regulated exchanges that want to operate in the country must follow anti‑money‑laundering (AML) and know‑your‑customer (KYC) rules. Platforms like CEX.IO, Bybit, Gemini, and Bit2Me have adapted their compliance programs to meet these requirements, offering local users a legal route for crypto activity.

The legal framework was solidified with the 2018 electronic‑money law, which explicitly excludes decentralized tokens from the definition of “electronic money.” The law’s primary purpose is to prevent a state‑issued digital currency from emerging without proper oversight. Because of this cautious approach, the official market is fairly transparent, but a shadow economy still finds ways to operate.

Why an Underground Market Exists

Even with legal avenues, several factors push users toward the black market:

- Tax avoidance: Crypto gains are taxable, and some prefer cash deals to sidestep filing.

- Privacy concerns: Mandatory KYC means personal data is stored by exchanges, prompting privacy‑focused traders to look elsewhere.

- Access to specific services: Certain stablecoins or privacy‑coins are not listed on regulated platforms, so users turn to informal channels.

- Speed and cost: Bank transfers can take days and carry fees; a direct cash hand‑off can be instantaneous and cheap.

These motivations fuel a clandestine ecosystem that mirrors the broader global trend of “off‑exchange” crypto activity.

How Underground Operations Work

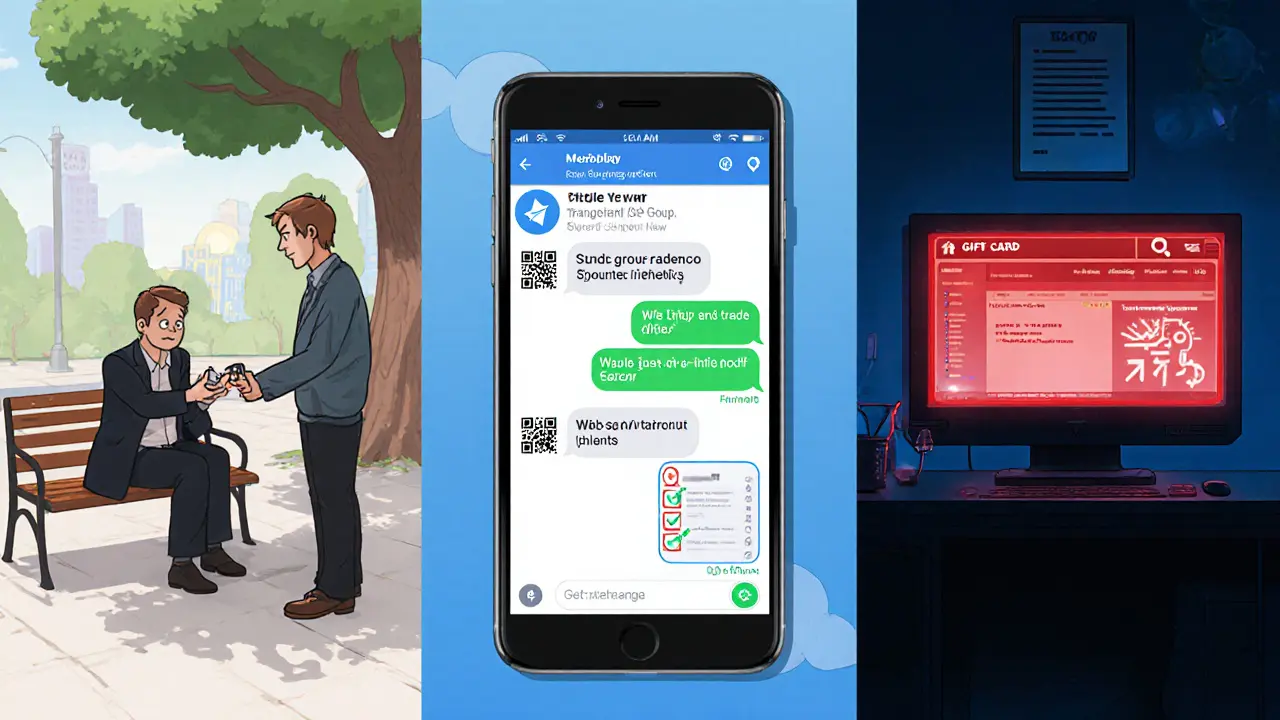

Underground trading in Ecuador isn’t a single monolith; it comprises several overlapping methods:

- Cash brokers: Individuals meet in cafés or public squares, exchange local currency for Bitcoin or USDT on the spot. They often use mobile wallets like Electrum to receive funds.

- Unregistered P2P groups: Closed Telegram or WhatsApp groups coordinate trades without the safeguards that platforms like Binance P2P provide. Members share payment instructions, escrow codes, and reputation scores manually.

- Darknet forums: Although less common in Ecuador than in larger economies, some users access international darknet marketplaces that list crypto‑selling services, paying with prepaid cards or gift codes.

- Hybrid P2P swaps: Users blend legal P2P services (e.g., LocalCoinSwap) with off‑platform negotiations, using the platform merely for initial matchmaking.

These channels typically lack the two‑factor authentication (2FA), cold‑storage protection, and audit trails that regulated exchanges enforce. As a result, disputes are settled informally, often leaving the losing party empty‑handed.

Risks and Red Flags

Operating outside the legal framework carries tangible dangers:

- Scams and rug pulls: Without escrow, a seller can disappear after receiving cash.

- Money‑laundering exposure: Authorities may treat large cash‑based crypto purchases as suspicious activity, leading to investigations.

- Security lapses: Private keys stored on personal devices are vulnerable to malware and phishing.

- Regulatory crackdown: The Financial Intelligence Unit (UIF) in Ecuador has hinted at future enforcement actions against unregistered brokers.

Spotting a red flag is often as simple as noting a lack of written agreement, unusually low fees (which may hide hidden costs), or demands for payment through non‑traceable channels like gift cards.

Legal Exchanges vs. Underground Channels

| Aspect | Regulated Exchanges (e.g., CEX.IO, Bybit) | Underground Channels |

|---|---|---|

| Legal status | Fully compliant with AML/KYC laws | Operates outside official oversight |

| Identity verification | Required (government ID, selfie) | None or minimal, often pseudonymous |

| Security measures | 2FA, cold storage, SSL encryption | Depends on individual practices; often none |

| Transaction speed | Minutes to hours (depends on method) | Immediate for cash trades, but settlement risk high |

| Fees | Transparent, tiered (0.1‑0.2% typical) | Unclear; hidden commissions common |

| Recourse | Customer support, dispute resolution | None; disputes settled informally |

| Privacy | Data shared with authorities when required | Higher anonymity, but also higher risk |

Staying Safe - Practical Tips for Ecuadorian Users

- Start with a regulated exchange: Open an account on a platform that complies with local AML/KYC rules. Verify the exchange’s security certifications (e.g., ISO27001, SOC2).

- Use hardware wallets for storage: Transfer any long‑term holdings to a device like Ledger or Trezor. Keep the recovery phrase offline.

- Limit cash‑only trades: If you must buy crypto with cash, do it in small amounts and only with people you trust personally.

- Check reputation on public forums: Before dealing with an underground broker, search for their nickname on Reddit’s r/EcuadorCrypto or local Telegram groups. Look for documented successful trades.

- Document everything: Keep screenshots of chats, payment receipts, and wallet addresses. This record can be useful if a dispute arises or if authorities inquire.

- Stay updated on regulations: The Ecuadorian Superintendency of Companies (Superintendencia de Compañías) occasionally issues new guidance on virtual assets. Subscribe to official bulletins or follow reputable crypto news sites.

- Report suspicious activity: If you suspect money‑laundering or fraud, you can anonymously tip the UIF. Cooperation helps keep the ecosystem cleaner for everyone.

Frequently Asked Questions

Is it illegal to trade crypto without using a registered exchange in Ecuador?

The law does not forbid private trades, but avoiding AML/KYC requirements can be considered a violation if the activity is linked to money laundering, tax evasion, or financing illegal activities. Authorities may pursue cases where large, unreported crypto transactions are detected.

What are the most common cryptocurrencies traded in the underground market?

Bitcoin (BTC) and Tether (USDT) dominate because they are liquid and widely accepted. Some traders also handle privacy‑focused coins like Monero (XMR), though those are less common due to higher technical barriers.

Can I lose my crypto if I use a cash broker?

Yes. Without escrow or a written contract, the broker can take the cash and never send the crypto. Always verify the broker’s reputation and consider using a small test transaction first.

Do Ecuadorian banks block crypto‑related transactions?

Banks are not required to block transfers to regulated exchanges, but they may flag large or repetitive crypto purchases for AML review. Some banks have added internal policies that limit transfers to known crypto platforms.

How can I report a fraudulent underground trader?

You can submit an anonymous tip to the Financial Intelligence Unit (UIF) via their online portal or contact the local police's cybercrime division. Provide as many details as possible: usernames, payment proofs, and communication logs.

Understanding the thin line between legal crypto activity and the hidden underground market helps you make smarter choices. By leaning on regulated platforms, keeping strong security habits, and staying aware of the risks, you can enjoy the benefits of digital assets without falling into the pitfalls that plague the shadow side of Ecuador’s crypto scene.

25 Comments

Shauna Maher

Look, the whole underground scene in Ecuador is a ticking time bomb, and the guys running those cash‑brokers probably have ties to far‑right militias. You think you’re just buying Bitcoin, but you’re funding a shadow network that’s invisible to regulators. If the state ever decides to crack down, you’ll be the first on the chopping block.

Linda Campbell

While the concerns raised are noteworthy, it is essential to acknowledge that the Ecuadorian legal framework does not criminalize private crypto exchanges per se. Nonetheless, adherence to AML and KYC regulations remains paramount for financial integrity.

EDMOND FAILL

Honestly, the post nails the main reasons folks slip into the underground market – tax avoidance and privacy freak‑outs. If you’re already on a regulated exchange, you’ve got built‑in protections like 2FA and insurance that cash‑brokers can’t match. Just remember, the more you hide, the more you invite trouble.

Jennifer Bursey

From a cultural standpoint, the allure of anonymity mirrors a broader distrust in institutional finance across Latin America. Those Telegram groups function like underground bazaars, complete with reputation scores and whispered referrals. It’s a vibrant, albeit risky, ecosystem that thrives on word‑of‑mouth credibility rather than formal escrow.

Maureen Ruiz-Sundstrom

Dark markets are just a scam factory.

Marques Validus

Yo, I’ve seen too many stories of dudes losing everything because they trusted that “trusted” cash broker. You hand over the money, they vanish like fog. My advice? Keep it on a regulated platform and use a hardware wallet when you can.

Mitch Graci

Wow, thanks for the groundbreaking insight 🙄. Next you’ll tell us that water is wet. 😂😂

Jazmin Duthie

Sure, anonymity sounds cool until you get ripped off.

Michael Grima

Underground trading is basically a digital Wild West – no sheriffs, just outlaws and desperate traders. The lack of escrow means you’re gambling your cash on a stranger’s word.

Michael Bagryantsev

Hey, just a heads‑up: if you’re thinking about using that “secret” P2P group, try a tiny test trade first. It’ll give you a sense of how trustworthy the other party is without risking a big chunk of your funds.

Maria Rita

Look, I get the fear of big exchanges holding your coins, but the reality is that hardware wallets protect you best. Put only what you need for day‑to‑day trading on an exchange and stash the rest offline. It’s the simplest way to avoid both hacks and shady brokers.

Jordann Vierii

Stay safe, stay savvy.

Lesley DeBow

I’m not a fan of emojis, but if you’re going to use them, at least pick ones that actually convey something. A simple ☝️ or ✅ can signal “trustworthy” without the drama of a 😂.

DeAnna Greenhaw

It is incumbent upon the discerning investor to recognize the inherent perils that accompany participation in an unregulated crypto marketplace. The absence of statutory oversight engenders a milieu wherein fraudulent actors operate with impunity, thereby compromising the fiduciary interests of participants. Moreover, the clandestine nature of these transactions obfuscates the provenance of funds, potentially implicating naïve users in contraventions of anti‑money‑laundering statutes. Consequently, one must maintain a rigorous due‑diligence protocol, encompassing thorough vetting of counterparties and meticulous documentation of all exchanges. In essence, prudence and regulatory compliance serve as the bulwarks against the capricious hazards inherent in the subterranean crypto sphere.

Luke L

All that high‑falutin talk doesn’t change the fact that most of these “reputable” brokers are just hustlers with a shiny website. Their promises of escrow are often just smoke, and when they disappear, you’re left with an empty wallet and a paper trail that no court will care about.

Cynthia Chiang

Hey guys, just wanted to say that the best way to protect yourself is to keep a log of every trade-screenshots, chat logs, payment receipts-so if something goes wrong you have proof. Also, don’t put all your crypto in one place; diversify across exchanges and hardware wallets.

Jim Greene

Positive vibes only! 🌟 Use a legit exchange and you’ll sleep better at night.

Della Amalya

Let me tell you a story: I once helped a friend navigate the murky waters of an unregistered P2P group. We started with $50, kept communication crystal‑clear, and validated each step with screenshots. In the end, the trade went smooth, but the experience taught us that patience and documentation are the true safety nets.

Teagan Beck

Keep it simple and stay on regulated platforms.

Kim Evans

Pro tip: When dealing with any underground trader, always ask for a proof‑of‑reserve screenshot from their wallet before sending cash. It’s a small step that can save you from a massive loss.

Steve Cabe

The patriotic thing about staying on a regulated exchange is that you’re not inadvertently funding criminal enterprises that could undermine national security. Moreover, compliance with AML/KYC not only protects you but also upholds the integrity of the financial system.

shirley morales

It’s astonishing how often people ignore the obvious red flags. A broker who refuses written agreements and offers “instant” cash trades is either reckless or malicious. Do yourself a favor and steer clear.

Mandy Hawks

When we contemplate the allure of underground crypto markets, we must first acknowledge the philosophical underpinnings of trust and risk. Trust, in its purest form, is a social contract that emerges from repeated positive interactions. In a regulated exchange, this contract is enforced by law, audits, and transparent governance. Conversely, an unregulated platform operates on a fragile trust, upheld solely by reputation scores and whispered assurances.

Such a fragile trust is susceptible to betrayal, especially when anonymity is prized above accountability. The anonymity that attracts privacy‑conscious users also shields bad actors, allowing them to execute scams without fear of repercussion. This creates a paradox where the very feature that draws participants-privacy-also erodes the foundation of trust.

Furthermore, the risk calculus changes dramatically when legal oversight is absent. In a regulated environment, institutions are obligated to implement anti‑money‑laundering measures, conduct due‑diligence, and maintain records that can be audited. These safeguards create a deterrent effect against illicit activity. Underground markets, lacking these mechanisms, become fertile ground for money‑laundering, fraud, and financing of illicit enterprises.

From a philosophical perspective, the decision to engage in such markets reflects a willingness to accept a higher degree of epistemic uncertainty. One must weigh the potential gains against the intangible costs of operating in a legal gray area. The ethical dimension cannot be ignored; participants may inadvertently become complicit in activities that undermine societal stability.

In conclusion, while the promise of privacy and tax avoidance may tempt some, the erosion of trust, heightened legal risk, and moral ambiguity present compelling arguments for favoring regulated avenues. The prudent path embraces transparency, security, and compliance, thereby safeguarding both personal assets and the broader financial ecosystem.

Millsaps Crista

Don’t let fear drive you into shady deals-use a reputable exchange and keep a hardware wallet for the big chunks.

Matthew Homewood

Philosophically, the tension between freedom and security is a timeless debate. In the crypto realm, this translates to choosing between the allure of unregulated anonymity and the safety of regulated oversight. It’s a personal calculus each trader must resolve.