Energy Savings Calculator

Compare Energy Use

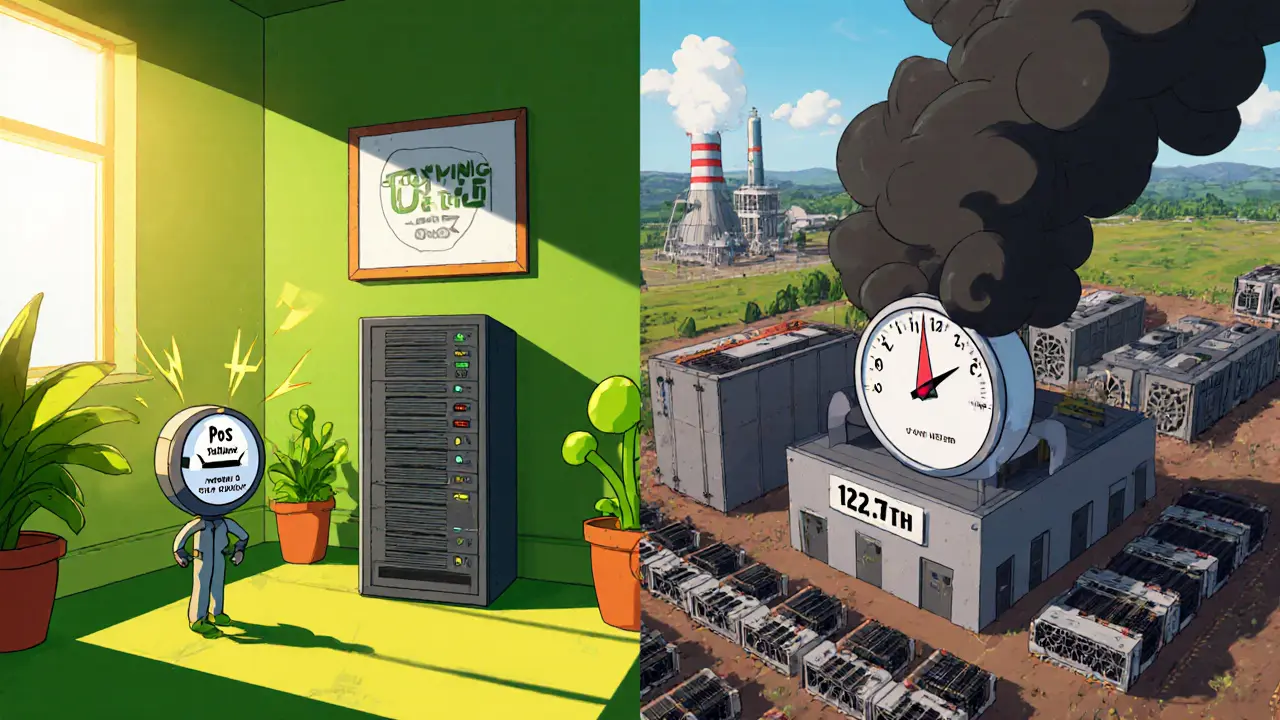

Calculate the energy savings of using Proof of Stake versus Proof of Work blockchains based on your transaction volume.

Based on:

Bitcoin (PoW): 707 kWh/transaction

Ethereum (PoS): 0.00017 kWh/transaction

Proof of Stake is a blockchain consensus mechanism where validators lock up a certain amount of cryptocurrency to earn the right to propose and attest to new blocks. By staking assets instead of burning electricity on cryptographic puzzles, PoS aims to cut energy waste, boost transaction speed, and align economic incentives with network security. In contrast, Proof of Work (PoW) relies on miners solving difficult hashes, a process that consumes massive power and demands expensive hardware. This article breaks down why PoS is increasingly seen as the superior choice for modern blockchains.

Key Takeaways

- PoS reduces energy consumption by up to 99.95% compared to PoW.

- Transaction throughput can grow from a few dozen TPS to hundreds of thousands with upcoming PoS upgrades.

- Security in PoS hinges on economic penalties (slashing) rather than raw compute power.

- Entry barriers shift from high‑cost ASIC rigs to capital‑based staking, opening new participation models.

- Centralization risks differ: PoW faces hash‑rate concentration, while PoS must manage stake concentration.

Energy Efficiency: The Most Visible Gain

Bitcoin’s PoW network burns roughly 121.7TWh of electricity per year - comparable to the total consumption of Norway. After "The Merge" in September2022, Ethereum’s PoS version uses about 0.01TWh annually, a drop of more than four orders of magnitude. Studies from the UCL Centre for Blockchain Technologies show a PoS‑like protocol (Hedera) uses 0.00017kWh per transaction, while Bitcoin needs about 707kWh per transaction - a 4million‑fold difference.

Because validators only need to run a standard server (8GB RAM, 1.5kWh daily), the operational cost drops to under $0.20 per day, versus $1‑$1.50 per day for a typical ASIC miner. For individual hobbyists, the savings are dramatic: a Reddit user reported $35/month electricity for an Ethereum validator versus $1,200/month for a pre‑Merge GPU rig.

Security Model: From Hash Power to Economic Stake

PoW security is rooted in the sunk cost of electricity and hardware. To attack Bitcoin, an actor would need to control >51% of global hash power, an estimated $13.5billion investment in 2023. PoS flips the equation - attackers must acquire >51% of the staked token supply. For Ethereum, that means roughly $32.6billion at October2023 prices. The economic penalty comes in the form of slashing: misbehaving validators lose a portion or the entirety of their stake. Slashing ranges from 0.5ETH for minor infractions to total loss of the 32ETH stake for severe attacks.

While PoW’s brute‑force approach has a longer track record, PoS’s game‑theoretic design ensures that attacks become financially suicidal. The "nothing at stake" problem - theoretically allowing validators to sign multiple forks - is mitigated by checkpointing and slashing rules introduced in Ethereum’s consensus layer.

Economic Incentives and Staking Dynamics

Validators lock up a predefined amount of cryptocurrency (e.g., 32ETH) and earn rewards proportional to their stake and network activity. According to Staking Rewards, average annual yields hover around 3.8% for major PoS chains, with predictable returns that many investors find attractive.

Staking pools and services like Lido lower the entry barrier, allowing participants to delegate as little as 0.1ETH while still receiving a share of rewards. However, pool concentration is a concern: Lido alone controlled 32.1% of staked ETH in October2023, raising questions about decentralization.

Scalability and Transaction Throughput

PoW limited Ethereum to ~15‑45TPS before the Merge. PoS opens the door to sharding, optimistic rollups, and other layer‑2 solutions, targeting 100,000TPS in the medium term. Solana’s PoS variant already processes 65,000TPS, and Cardano’s upcoming Hydra protocol promises similar numbers. Higher throughput reduces congestion fees, making blockchains more viable for everyday payments and DeFi applications.

Accessibility and Hardware Requirements

Mining PoW demands specialized ASICs costing $2,000‑$15,000 plus high electricity bills. In contrast, a PoS validator can run on a modest desktop or a low‑cost cloud VM - roughly $500‑$1,000 for the hardware and $35/month for electricity. Setup time shrinks from weeks of research (for a competitive mining rig) to 2‑4hours for a technically competent user.

Despite lower hardware costs, the capital lock‑up (e.g., 32ETH ≈ $89,600 in Oct2023) represents a significant financial commitment. This shift moves the barrier from technical expertise to capital availability.

Centralization Concerns: Different Flavors of Concentration

PoW’s concentration is measured by hash‑rate share: the top three mining pools control ~54.7% of Bitcoin’s hash power. PoS concentration is tracked by stake share: the top three Ethereum validators hold ~42.1% of the total staked supply. Both pose decentralization risks, but the mechanisms differ. PoW centralization can be mitigated by mining pool diversification; PoS centralization is addressed through staking pools, delegated proof‑of‑stake designs, and governance mechanisms that incentivize broader participation.

Future Outlook: Why PoS Is Gaining Momentum

Market data from CoinGecko shows PoS chains representing 38.7% of total crypto market cap in Oct2023, up from 12.3% a year earlier. Enterprise surveys (Gartner, 2023) reveal 78% of new blockchain projects opting for PoS variants. Regulatory trends, such as the EU’s MiCA framework, treat PoS tokens as assets, easing compliance compared to PoW’s commodity classification.

Technical roadmaps are aggressive. Ethereum plans Verkle Trees in 2024 to cut state storage by 90%, while Solana and Cardano continuously improve hardware‑light consensus algorithms. Forecasts from the Network for Decentralized Applications predict PoS networks will handle 82% of all blockchain transactions by 2025.

Side‑by‑Side Comparison

| Aspect | Proof of Stake (PoS) | Proof of Work (PoW) |

|---|---|---|

| Energy Use | ~0.01TWh/yr (Ethereum post‑Merge) | ~121.7TWh/yr (Bitcoin) |

| Transaction Throughput | 15‑45TPS now; up to 100,000TPS with sharding/rollups | ≈7‑15TPS (Bitcoin) |

| Hardware Cost | Standard PC or cloud VM ($500‑$1,000) | ASIC rigs ($2,000‑$15,000 each) + high electricity |

| Security Model | Economic stake + slashing penalties | Hash‑rate majority & energy cost |

| Entry Barrier | Stake requirement (e.g., 32ETH ≈ $90k) or pool delegation | Capital for ASICs + ongoing electricity costs |

Practical Tips for New Validators

- Ensure a reliable internet connection - aim for 99.9% uptime to avoid slashing.

- Consider a backup node or cloud‑based failover for redundancy.

- Start with a staking pool if you cannot meet the full stake amount.

- Monitor validator performance dashboards (e.g., Beaconcha.in) daily.

- Stay updated on protocol upgrades - they can affect reward rates and security parameters.

Frequently Asked Questions

Does Proof of Stake eliminate the risk of 51% attacks?

PoS reduces the economic feasibility of a 51% attack because an attacker must acquire a majority of the staked tokens. While not impossible, the cost is comparable to buying a huge share of the cryptocurrency, making attacks financially suicidal.

Can I participate in staking without owning 32ETH?

Yes. Many services let you delegate as little as 0.1ETH or even fiat, pooling your stake with others. However, check the platform’s fees and the concentration of power among large pools.

Is PoS better for the environment?

By most estimates, PoS consumes 99.5‑99.95% less energy than PoW. This translates to a dramatic drop in carbon emissions, making PoS the greener choice for most blockchain use cases.

Will PoS networks become more centralized over time?

Stake concentration is a real concern, especially when a few pools control a large share. Protocols counter this with incentives for smaller validators and mechanisms to limit the influence of any single entity.

What are the biggest drawbacks of PoS?

High capital lock‑up, potential stake‑centralization, and the need for reliable uptime (to avoid slashing) are the main challenges. New users must also navigate more complex staking contracts compared to simply buying hardware.

18 Comments

Hari Chamlagai

The core advantage of Proof‑of‑Stake is that it aligns economic incentives directly with network security; validators have skin in the game, so any attack threatens their own capital. By staking, participants lock up value that can be slashed if they deviate, turning malicious intent into a financially suicidal proposition. This contrasts sharply with Proof‑of‑Work, where the cost of an attack is measured in electricity and hardware, not in the same liquid assets that power the ecosystem. Moreover, PoS eliminates the race for ever‑faster ASICs, which perpetuates centralization among entities that can afford the latest rigs. The result is a more level playing field for participants who can run a validator on modest hardware. Energy consumption drops by orders of magnitude, delivering a greener footprint that cannot be ignored. In addition, the deterministic finality of PoS reduces the probability of deep chain reorganizations, strengthening user confidence. Finally, the economic model enables predictable reward structures, which attract institutional capital seeking stable yields. All these factors combine to make PoS a superior consensus mechanism in the long run.

Jason Clark

Sure, because nothing screams “innovation” like burning megawatts of electricity to solve a cryptographic puzzle that could be replaced by a simple ledger entry. The math is straightforward: PoW requires roughly 707 kWh per transaction on Bitcoin, while PoS trims that to a microscopic 0.00017 kWh on Ethereum. That’s a reduction of more than 99.9 %, which any serious environmental analyst would call a ‘trivial’ improvement. From a cost perspective, miners must also invest in expensive ASICs that become obsolete within months, whereas a validator can run on a mid‑range laptop. The opportunity cost of capital is therefore dramatically lower in PoS. If you enjoy paying for electricity that could power a small town, stick with PoW; otherwise, the economics simply favor staking.

Jim Greene

Wow, the numbers really make PoS look like the superhero of blockchain tech 🚀

It’s amazing how you can slash energy use and still keep the network secure, all while earning a decent yield. Staking also opens the door for everyday users to participate without hunting down obscure hardware. 🌱💰 Plus, the lower barrier to entry means more people can join the future of finance. Keep the optimism flowing, and soon we’ll see a greener, more inclusive crypto world!

Teagan Beck

Honestly, the shift to PoS feels like the crypto world finally growing up a bit. It’s less about who has the biggest mining farm and more about who’s willing to lock up some stake responsibly. That’s a refreshing change of pace.

Blue Delight Consultant

When one contemplates the ontological implications of delegating trust via staked capital, it becomes evident that PoS is not merely a technical upgrade but a philosophical reorientation. The act of staking resembles a covenant, binding participants to the collective welfare while preserving individual sovereignty. Yet, such elegance is not without peril; concentration of stake in large pools threatens the very decentralisation that underpins blockchain ethos. Therefore, the discourse must balance the allure of efficiency with vigilant scrutiny of power dynamics. In this light, PoS can be seen as a mirror reflecting both the aspirations and the anxieties of its adopters.

Gautam Negi

It is a tragic irony that the very mechanism designed to democratise finance may, in practice, re‑create old hierarchies under a different veneer. While PoS advertises accessibility, the requirement of 32 ETH-equivalent to nearly ninety thousand dollars at current rates-places an insurmountable barrier for the average citizen. This capital lock‑up consolidates power among the affluent, echoing the concentration of mining equipment seen in Proof‑of‑Work. Moreover, the notion that “nothing at stake” eliminates double‑signing is a comforting myth; checkpointing and slashing merely replace one set of incentives with another, often opaque, set. Validators, driven by the prospect of steady, modest returns, may be tempted to collude, especially when a handful of staking pools dominate the network. The dramatic escalation of Lido’s share to over thirty percent exemplifies this risk, turning a once‑decentralised system into a quasi‑centralised service provider. Critics argue that such centralisation undermines the philosophical foundations of blockchain, yet proponents dismiss these concerns as teething problems. The reality is that any consensus algorithm operates within the constraints of economic incentives, and PoS is no exception. Its game‑theoretic design does not inherently guarantee equitable participation; it simply reshapes the battlefield. The environmental benefits, while laudable, cannot mask the emerging socioeconomic inequities. As we contemplate the future of blockchain, we must ask whether we are trading one form of domination for another, cloaked in the language of sustainability. Only a vigilant, well‑informed community can ensure that the promise of PoS does not dissolve into a new oligarchy. Regulatory frameworks will soon grapple with these staking dynamics, potentially imposing caps on pool sizes. Community governance proposals are already surfacing, aiming to redistribute rewards more evenly. Meanwhile, the market continues to reward large validators with lower fees, reinforcing the feedback loop. The ultimate test will be whether PoS can evolve without sacrificing the decentralised ethos it claims to uphold.

Shauna Maher

All of this is just a ploy by the elite to keep us powerless.

Kyla MacLaren

Hey team, I think we should all share resources and maybe run small validators together so no single pool gets too big. It could help keep the network healthy.

Linda Campbell

While collaborative staking is noble in intent, let us not forget that the sovereignty of our nation's digital assets must remain uncompromised. Centralized pools, even if well‑meaning, pose a risk of foreign influence that could undermine national security. Therefore, any joint endeavor should be subject to strict oversight to ensure alignment with our national interests.

Kevin Duffy

Staking is like planting a tree 🌳-you watch it grow and harvest the fruit later. The passive income feels rewarding, especially when the market is volatile. Keep sowing those seeds, and the future will be greener for everyone! 😊

Lesley DeBow

The act of staking invites us to reflect on the nature of trust; we bind our wealth to a collective promise, echoing ancient social contracts. In doing so, we participate in a digital covenant that transcends borders. Yet, we must remain vigilant, for the very mechanisms that empower can also enslave. 😊

Luke L

Your romanticized view ignores the harsh reality that most validators are driven by profit, not philosophy. This is especially true when foreign entities funnel capital into our staking pools, compromising our sovereignty.

Cynthia Chiang

Hey there! It's great that you're exploring staking-it's a big step towards understanding crypto ecosystems. Remember, defirentiate your stake across multiple pools if you can; it reduces risk and promotes decentralization. If you need help setting up a validator, just let us know and we'll guide you through the process. Good luck!

Ben Johnson

Interesting breakdown, but I wonder how many of those 100,000 TPS projections actually survive real‑world usage without massive centralization. The hype often outpaces the tech.

Della Amalya

When you imagine a world where transactions flow as freely as water, you can feel the pulse of progress. Staking brings us closer to that vision, turning abstract code into tangible change. Let’s champion this evolution together.

Scott G

Esteemed participants, the discourse surrounding Proof‑of‑Stake warrants meticulous examination. It is imperative that we assess both the quantitative benefits and the qualitative ramifications. Only through rigorous analysys can we arrive at a prudent consensus.

VEL MURUGAN

From an objective standpoint, the data unequivocally demonstrates that PoS outperforms PoW across energy consumption, scalability, and economic efficiency. Any claim to the contrary is either ignorance or willful misinformation. The numbers speak for themselves.

Millsaps Crista

Keep pushing forward with your validator setup-regular monitoring and timely updates are key. If you hit a snag, don’t hesitate to reach out; the community thrives on shared progress.