Crypto Regulations and Exchanges in 2025: Global Bans, Licensing, and Scams

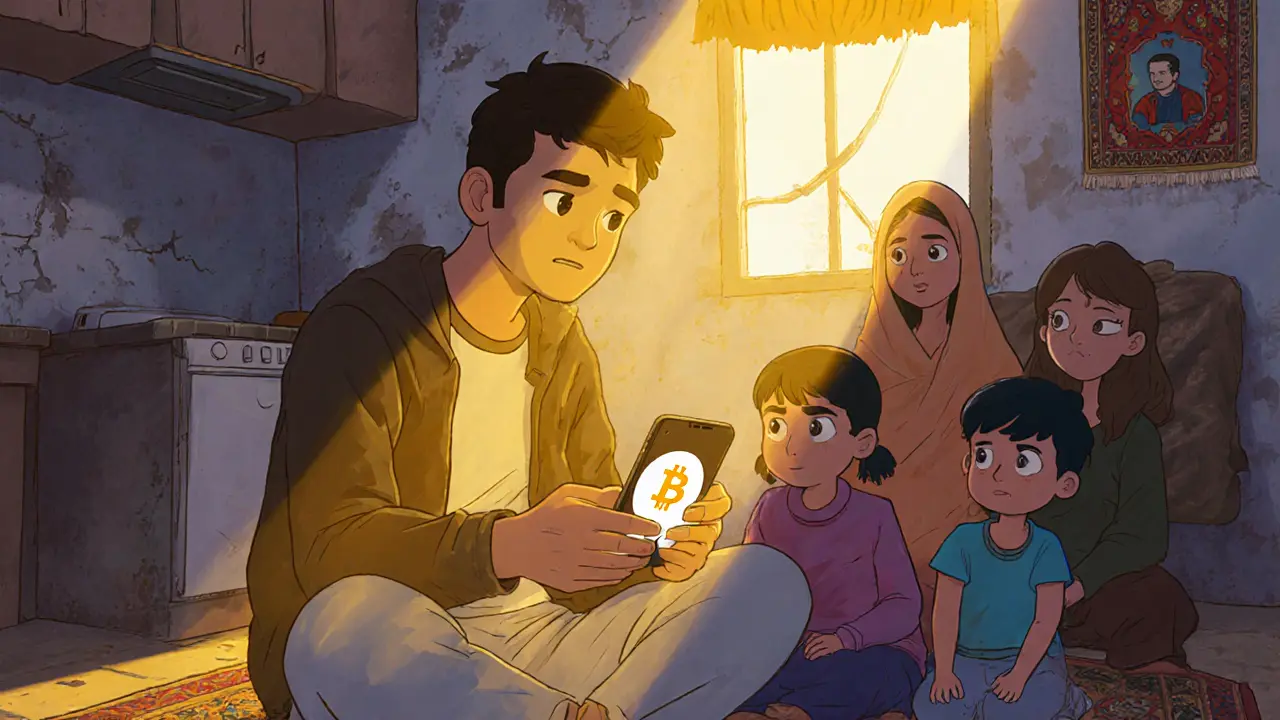

When navigating crypto regulations 2025, the evolving legal frameworks that govern digital asset trading across countries. Also known as digital asset compliance, it determines whether you can trade, hold, or even access crypto without risking fines or jail time. This wasn’t just about rules—it was about survival. In 2025, countries like China and Thailand shut down foreign platforms entirely, while Switzerland and Germany pushed for clearer licensing. If you were trading crypto in October 2025, you weren’t just watching prices—you were navigating a minefield of legal traps.

crypto exchanges, platforms where users buy, sell, or trade digital assets, often with varying levels of oversight and security. Also known as crypto trading platforms, it became clear that not all exchanges were created equal. Platforms like WOOFi and Sovryn offered cross-chain swaps and Bitcoin-native DeFi tools with no KYC, while others like DXBxChange and CanBit faced intense scrutiny over security and transparency. Meanwhile, exchanges tied to regions under strict bans—like Binance in China or Bybit in India—were no longer options. The ones that survived were either fully licensed, like those under FINMA or BaFin, or completely decentralized and untraceable. And then there were the airdrops. crypto airdrops, free token distributions meant to bootstrap adoption, often used by new or fraudulent projects. Also known as token giveaways, they exploded in October 2025. Some, like SPAT and GameZone, had clear steps and working contracts. Others, like Lunar Crystal and RichQUACK, vanished after promising riches—no smart contracts, no tokens, just hype. Meanwhile, scams like Department of Government Efficiency (DOGE) and Numogram (GNON) kept popping up, dressed up as AI-powered blockchain revolutions with zero code, zero users, and zero future.

What you’ll find here isn’t theory. It’s what actually happened. From the Taliban’s crypto crackdown in Afghanistan to Thailand’s P2P ban, from SEC’s $4.68B fines to Switzerland’s $10M licensing costs—this archive pulls back the curtain. You’ll see which exchanges still worked, which airdrops were real, and which tokens were just digital ghosts. No fluff. No guesses. Just what you needed to know to stay safe, stay legal, and avoid losing your money to the next shiny scam.