HitBTC Fee Calculator

Calculate Your Trading Fees

Estimate potential savings with HitBTC based on your trading volume and HIT token holdings.

Estimated Fees

Spot fees: $0.00

Futures fees: $0.00

Total fees: $0.00

Risk assessment: Medium

Comparison with Regulated Exchanges

Estimated savings compared to Binance: $0.00

Note: This calculation does not account for withdrawal risks, security, or regulatory protections

HitBTC has been around since 2013, and if you’ve been in crypto long enough, you’ve probably heard of it. It’s not Binance. It’s not Coinbase. But for traders who care about low fees and deep markets, HitBTC still shows up on the radar. The question isn’t whether it’s powerful-it is. The real question is: Is it safe? And in 2025, with regulators cracking down everywhere, that’s the only thing that matters.

What HitBTC Actually Offers

HitBTC isn’t trying to be a beginner-friendly app. It doesn’t have TikTok-style tutorials or one-click buys. It’s a professional-grade platform built for traders who know what a limit order is and why leverage matters. You get access to over 800 trading pairs, including spot, margin, and futures. That’s more than most exchanges offer. The platform supports 476 different cryptocurrencies, and you can trade with up to 100x leverage on futures. That’s not for casual users-it’s for people who know how to manage risk.The fee structure is where HitBTC shines. Default spot trading fees are 0.12% for makers and 0.25% for takers. That’s higher than Binance’s lowest tier, but if you hold HIT tokens-the platform’s native coin-you can cut those fees by up to 45%. For active traders moving large volumes, that’s a real saving. Futures trading fees are even lower: between 0.02% and 0.05%. Plus, market makers get rebates of up to 0.01% per trade. If you’re providing liquidity, HitBTC pays you to do it.

Deposits are easy. You can start with as little as $1. You can buy crypto using Visa, Apple Pay, or Google Pay through their integrated fiat gateway. But here’s the catch: you can’t hold fiat in your HitBTC account. You buy crypto, and that’s it. No USD, EUR, or AUD balances. That’s fine if you’re already in crypto, but if you’re new, it adds friction.

The Big Problem: No Regulation

HitBTC is based in Hong Kong and has a representative office in Chile. But here’s the thing-it’s not licensed or regulated by any financial authority. Not the SEC. Not the FCA. Not even Hong Kong’s SFC. That means there’s no legal protection if something goes wrong. No insurance. No oversight. No recourse if your funds disappear.This isn’t a minor detail. It’s the elephant in the room. In 2025, every major exchange either complies with regulations or gets shut down. Binance paid $4.3 billion in fines to avoid a total ban. Kraken settled with the SEC. Even smaller exchanges like KuCoin are now applying for licenses. HitBTC hasn’t made a single public move toward compliance. That’s not neutrality-it’s a red flag.

Some users defend HitBTC by saying, “It’s just a tool.” But tools don’t freeze accounts. Tools don’t ignore police requests. Tools don’t disappear with your money. And according to multiple user reports, HitBTC has done all three.

User Experience: Fast Trading, Slow Support

If you’re a technical trader, the interface is surprisingly capable. The API is robust, supports algorithmic trading, and is used by bots and hedge funds. The charts are detailed, order types are advanced, and the platform rarely crashes under heavy load. That’s why experienced traders still use it.But the moment you need help, everything falls apart.

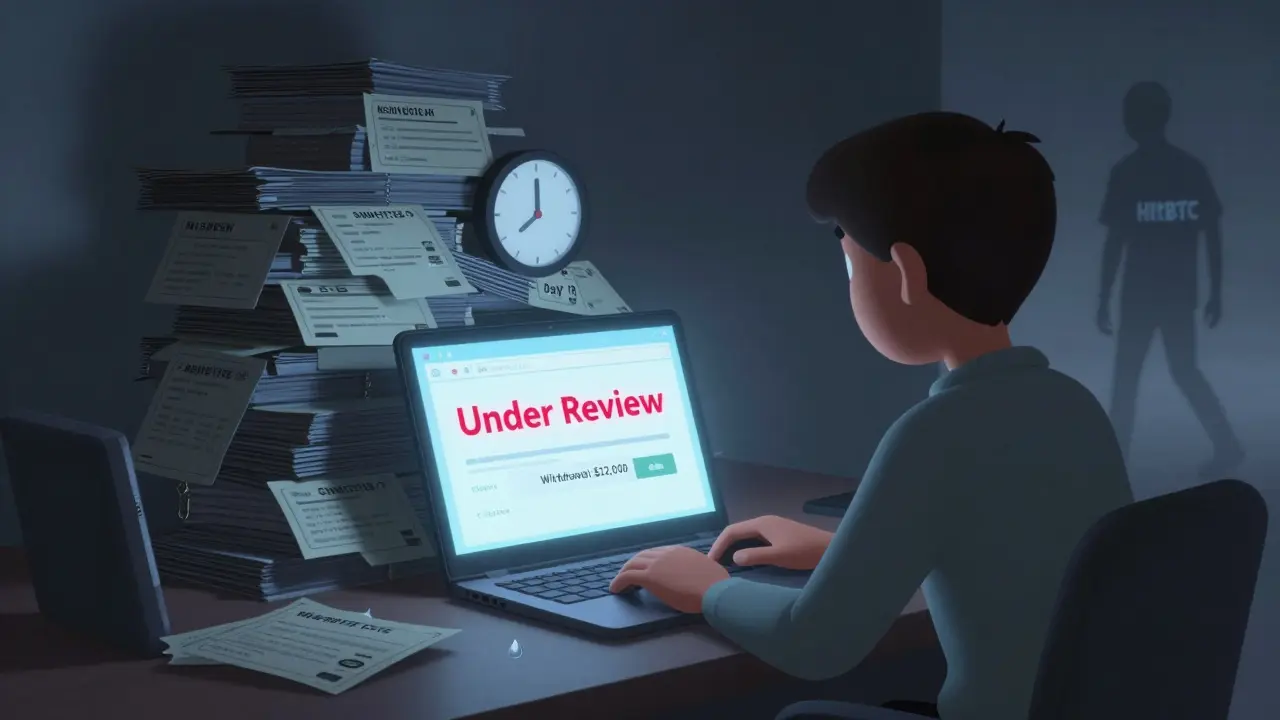

Customer support ratings on TrustPilot, CryptoRadar, and G2 hover around 2 out of 5. Users report waiting days-sometimes weeks-for responses to withdrawal requests. One trader in New Zealand reported a $12,000 withdrawal stuck for 19 days. When he contacted support, he got a generic reply: “We’re processing.” No timeline. No explanation. No apology.

Account freezes are common. Users describe logging in one day to find their funds locked with no warning. Some say they were asked to provide documents they’d already submitted. Others were told their accounts were “under review” for months with no clear reason. There’s no escalation path. No live chat. No phone number. Just tickets that vanish into a black hole.

Withdrawal Issues: A Pattern, Not an Accident

This isn’t just one bad review. It’s a pattern.On Reddit, multiple users from Europe and North America describe identical experiences: successful trades, then a withdrawal delay. Then a request for “additional verification.” Then silence. Some users claim they were eventually paid after weeks of pressure. Others say they gave up and lost their funds.

Worse, G2 reviews include serious allegations: HitBTC allegedly refused to cooperate with law enforcement investigating stolen crypto. One user reported that after police subpoenaed HitBTC for transaction records tied to a hack, the exchange didn’t respond. That’s not incompetence-that’s a legal risk. And if you’re holding crypto on HitBTC, you’re indirectly exposed to that risk.

There’s a difference between a slow exchange and a dangerous one. HitBTC isn’t just slow. It’s unresponsive when it matters most.

Who Should Use HitBTC? (And Who Should Avoid It)

Let’s be clear: HitBTC isn’t for everyone.Use HitBTC if:

- You’re an experienced trader who understands leverage, liquidations, and risk management

- You trade high volumes and want to save on fees using HIT tokens

- You’re comfortable with zero regulatory protection

- You’re using it for short-term trading, not long-term holding

Avoid HitBTC if:

- You’re new to crypto

- You plan to store significant funds there

- You need reliable customer support

- You care about legal protection or insurance

There are better options for most people. Binance, Kraken, and Coinbase all offer similar trading tools-but with regulation, insurance, and support that actually works. If you’re trading small amounts and want to learn, start there. Save HitBTC for when you’re ready to take on the risks of an unregulated platform.

The Bottom Line in 2025

HitBTC is technically impressive. The trading engine is fast. The fee structure is competitive. The number of trading pairs is massive. But none of that matters if you can’t get your money out.Regulation isn’t a bug-it’s a feature. It’s the safety net that separates platforms you can trust from ones you should treat like a casino. HitBTC has no safety net. It’s a high-risk, high-reward playground for pros who know the odds. But for everyone else? It’s a gamble with your life savings.

In 2025, with global crypto regulations tightening, HitBTC’s lack of compliance isn’t just a weakness-it’s a countdown. The longer it waits to change, the more likely it is to vanish overnight. And if that happens, your funds won’t be recoverable.

Trade on HitBTC if you’re prepared to lose everything. But don’t say you weren’t warned.

Is HitBTC safe to use in 2025?

No, HitBTC is not considered safe for most users. It operates without any financial regulation, meaning there’s no legal protection if funds are lost, frozen, or stolen. While the platform is technically strong, repeated user reports of withdrawal delays, unresponsive support, and refusal to cooperate with law enforcement make it a high-risk choice. Only experienced traders who accept full responsibility for their funds should consider using it.

Does HitBTC support fiat deposits?

Yes, but only to buy crypto. You can deposit USD, EUR, or other fiat currencies using Visa, Apple Pay, or Google Pay through HitBTC’s integrated third-party exchanger. However, you cannot hold fiat balances in your HitBTC account. All funds must be converted to cryptocurrency immediately. This makes it less convenient than exchanges like Kraken or Coinbase, which let you store and manage fiat directly.

What are the trading fees on HitBTC?

Spot trading fees start at 0.12% for makers and 0.25% for takers. Futures fees are lower, ranging from 0.02% to 0.05%. These fees drop significantly if you hold HIT tokens-up to 45% off depending on your token balance. Market makers also earn rebates of up to 0.01% per trade. While not the cheapest overall, HitBTC’s fee structure is among the most attractive for high-volume traders who use the native token.

Can I use HitBTC on mobile?

Yes, HitBTC has a mobile app available for iOS and Android. The app supports spot and futures trading, order placement, and portfolio tracking. However, user reviews note that the interface is clunky and lacks the polish of apps from Binance or Kraken. Customer support is also inaccessible via mobile, so if you run into issues, you’ll still need to use a desktop browser to submit tickets.

Why do people say HitBTC freezes accounts?

Users report account freezes for unclear reasons, often after large withdrawals or unusual trading patterns. HitBTC claims these are security measures, but there’s no transparent process to resolve them. Many users describe being asked for duplicate KYC documents, waiting weeks for replies, or receiving no response at all. The lack of communication and official policy makes account freezes feel arbitrary and uncontrollable, adding significant risk for anyone holding funds there.

Is HitBTC better than Binance or Kraken?

Only for a very narrow group: advanced traders who prioritize low fees and deep liquidity over safety and support. Binance and Kraken offer similar trading tools but with regulation, insurance, 24/7 support, and faster withdrawals. HitBTC’s only real advantage is its fee discounts for HIT token holders and slightly higher leverage options. For 95% of users, the risks of using HitBTC far outweigh those small benefits.

25 Comments

Nina Meretoile

HitBTC is like that one friend who’s crazy smart but never answers your texts. You know they’ve got the goods, but you’re always left wondering if they’re gonna ghost you when you need them most. 🤷♀️

Adam Bosworth

lol so hitbtc is a casino? wow who saw that coming?? 💀

Elizabeth Miranda

I’ve used HitBTC for 2 years now. Never had an issue with withdrawals, but I also never held more than $500 there. I treat it like a trading tool, not a bank. If you’re storing life savings on it? Yeah, that’s not smart. But for active spot and futures? It’s still one of the cleanest engines out there.

Chloe Hayslett

Oh wow, a crypto exchange that doesn’t kiss the SEC’s ass? How dare they. Next you’ll tell me Bitcoin was invented by a guy who didn’t file Form 8949.

Manish Yadav

This is why crypto is dangerous. People risk everything on platforms that dont even follow rules. God will judge those who gamble with their money like this.

Vincent Cameron

There’s a difference between being unregulated and being criminal. HitBTC doesn’t pretend to be a bank. It’s a decentralized trading floor. If you want insurance, go to a brokerage. If you want freedom, you take the risk. The market doesn’t owe you safety.

Noriko Robinson

I used to trade here a lot but switched to Kraken after a 12-day withdrawal delay. I get the low fees, but when you need cash and nobody responds? That’s not a feature, it’s a flaw. I just want to know my money’s not trapped.

Yzak victor

Look, I’m not saying it’s safe. But I’m also not saying it’s a scam. It’s just… old school. Like a manual transmission car. Hard to drive, no airbags, but if you know what you’re doing, it’s faster than anything automatic. Just don’t expect the dealer to help you when you stall.

Josh Rivera

Oh so now it’s a ‘gamble’? Wow. So every exchange that doesn’t have a license is a casino? Then Binance is a casino too, since they got fined for not having one. You’re not critiquing HitBTC-you’re just scared of freedom.

Neal Schechter

If you’re using HitBTC for anything over $1k, you’re either a pro or you’re playing Russian roulette. The platform’s API is top-tier, the liquidity is insane, and the fees are brutal for big traders. But if you’re not monitoring your account daily or you don’t have a backup wallet? You’re asking for trouble. It’s not evil-it’s just not for you.

Tara Marshall

Withdrawal delays are real. Support is garbage. But the charts are the best I’ve ever seen. I use it for one thing: scalping. I deposit, trade, withdraw. No holding. No drama.

Nelson Issangya

People need to stop acting like regulation is a magic shield. The SEC doesn’t protect you from hacks or scams. It just makes you feel safe while they take your tax money. HitBTC might be wild, but at least they don’t charge you $10 to move your own crypto.

Joe West

I’ve been on HitBTC since 2018. Never had an issue. I use HIT tokens to cut fees and I only keep what I’m actively trading. The rest is in a cold wallet. It’s not about the exchange-it’s about how you use it.

Frank Cronin

Wow. A platform that doesn’t beg for regulatory approval? How revolutionary. Must be why it’s still alive while all the compliance zombies are getting bought out by Wall Street. Keep your KYC, keep your insurance. I’ll take my liquidity and my freedom.

Stanley Wong

Look I get it people are scared of unregulated platforms but you have to understand that regulation is just another form of control and if you want true decentralization you have to accept that some platforms will operate outside the system and if you’re not okay with that then maybe crypto isn’t for you because the whole point is to remove intermediaries and if you need someone to hold your hand every time you trade then go back to Robinhood

Sandra Lee Beagan

I’m Canadian and I’ve used HitBTC for years. The mobile app is trash, but the desktop platform? Unbeatable for algo trading. I’ve had two withdrawals take 7 days, but I sent them polite follow-ups and they cleared. I think support just gets buried under volume. It’s not malicious-it’s understaffed.

Chris Jenny

They’re working with the shadow government. I saw a post on 4chan-HitBTC is a front for the CIA to track crypto flows. That’s why they freeze accounts. They’re not ignoring subpoenas-they’re obeying orders. You think this is about money? No. It’s about control.

Uzoma Jenfrancis

Why do you care if they are regulated? The US government steals your money with taxes. HitBTC lets you keep it. That’s freedom. Stop crying about safety and start learning how to protect yourself.

Jerry Perisho

Has anyone tried contacting them via Telegram? I heard some users get faster replies there. Not official, but it’s a workaround. I’ve had tickets go unanswered for weeks, but a DM on Telegram got me a response in 2 days.

Doreen Ochodo

Use it for trading. Don’t store. Simple.

Holly Cute

Everyone’s acting like HitBTC is the devil because it doesn’t kiss the SEC’s ring. Meanwhile, Binance paid $4.3B to avoid being shut down. So what? They’re still operating. Kraken settled. KuCoin’s applying. So the only ‘safe’ exchange is the one that’s already paying off the regulators? That’s not safety-that’s corruption dressed up as compliance.

Billye Nipper

I love how people say 'you knew the risks' like that's an excuse. What if you're 70 and you put your retirement into crypto because your bank pays 0.1% interest? You're not a trader-you're just trying to survive. HitBTC isn't a tool for people like me. It's a trap for the desperate.

Glenn Jones

hitbtc is the crypto version of a 90s dialup internet provider-slow, glitchy, but somehow still here because the tech is actually kinda good? no one uses it for the customer service, they use it because they’re too lazy to migrate their bots to a new API. and honestly? i get it. the liquidity is insane. just dont hold your life savings there. and if you do? you deserve what you get.

Nicole Parker

I think we’re missing the point. HitBTC isn’t trying to be trusted. It’s trying to be free. And maybe that’s the real value here-not in the fees or the pairs, but in the fact that someone still built something that refuses to bow to bureaucracy. I don’t use it for my main portfolio, but I keep a small account there as a reminder that crypto was meant to be wild.

michael cuevas

lol if you think regulation = safety you’ve never seen what the SEC actually does. they don’t protect you, they just make sure you pay more taxes. hitbtc is the real deal. everyone else is just a bank with a blockchain sticker.