For years, Pakistan’s government told its citizens: crypto is illegal. Banks were ordered to block transactions. Exchanges were shut down. The State Bank of Pakistan issued warnings. But none of that stopped millions of people from trading cryptocurrency - and today, Pakistan is one of the top three crypto markets in the world, with an estimated $300 billion in annual trading volume. How? Because when people have no other way to protect their money, they find a way.

Why Crypto Took Off in Pakistan

The Pakistani rupee has been losing value for over a decade. Inflation hit 35% in 2024. Savings evaporated. People couldn’t send money abroad without paying 20% in fees or waiting weeks. Banks refused to help freelancers, IT workers, or remittance recipients. That’s when crypto stepped in - not as a speculative gamble, but as a survival tool. Bitcoin became a digital savings account. USDT (Tether) became the new rupee. People used Easypaisa and JazzCash - Pakistan’s most popular mobile payment apps - to buy crypto from strangers online. No bank needed. No paperwork. No delays. Just a phone, a QR code, and trust. By 2025, over 40 million Pakistanis were actively using cryptocurrency. That’s more than the entire population of Australia. And it wasn’t just tech-savvy millennials. Shop owners, farmers, nurses, and taxi drivers were all trading. Why? Because they had no choice.The $300 Billion Number - What It Really Means

The $300 billion figure sounds huge. And it is. But here’s the catch: it’s not from official exchanges. It’s from peer-to-peer (P2P) trades. Most of this trading happens on platforms like LocalBitcoins, Paxful, and local Telegram groups. Traders meet in person, send money through mobile wallets, and get Bitcoin or USDT in return. There’s no central record. No government tracking. Just thousands of daily cash swaps. CoinLaw, a crypto analytics firm, says only 18.2 million users are verified on tracked platforms. But that’s just the tip of the iceberg. The rest - the ones using WhatsApp, Facebook groups, or local bazaars - aren’t counted. That’s why estimates range from 20 million to over 40 million users. The $300 billion includes every single trade, every swap, every payment made in crypto over a year. To put it in perspective: if Pakistan’s crypto volume were a country’s GDP, it would rank higher than Sri Lanka’s entire economy. And it’s all happening without a single licensed crypto exchange operating inside the country.What People Are Trading - And Why

Bitcoin is still the #1 choice. It’s seen as digital gold - a way to hold value when the rupee keeps falling. But USDT, the stablecoin pegged to the US dollar, is the real workhorse. It’s used for everyday transactions: paying for web design work, sending money to family abroad, buying imported goods online. Ethereum is growing fast, too. Not because people are into DeFi or NFTs. But because smart contracts let freelancers automate payments. A developer in Lahore can set up a contract that releases funds only after a client approves the code. No middleman. No chargebacks. No bank delays. And it’s not just Bitcoin and USDT. Dogecoin, Solana, and even Monero are used - especially in rural areas where privacy matters. People don’t want the government knowing every transaction they make.

How the System Works - No Banks Allowed

There are no official crypto exchanges in Pakistan. Binance, Coinbase, Kraken - they’re all blocked. So how do people buy crypto? They use P2P platforms. Here’s how it works:- You find a seller on Paxful or LocalBitcoins offering USDT for PKR.

- You send money through JazzCash or Easypaisa - just like paying a utility bill.

- The seller confirms receipt, then releases crypto to your wallet.

- You transfer it to a hardware wallet or hold it in an app like Trust Wallet.

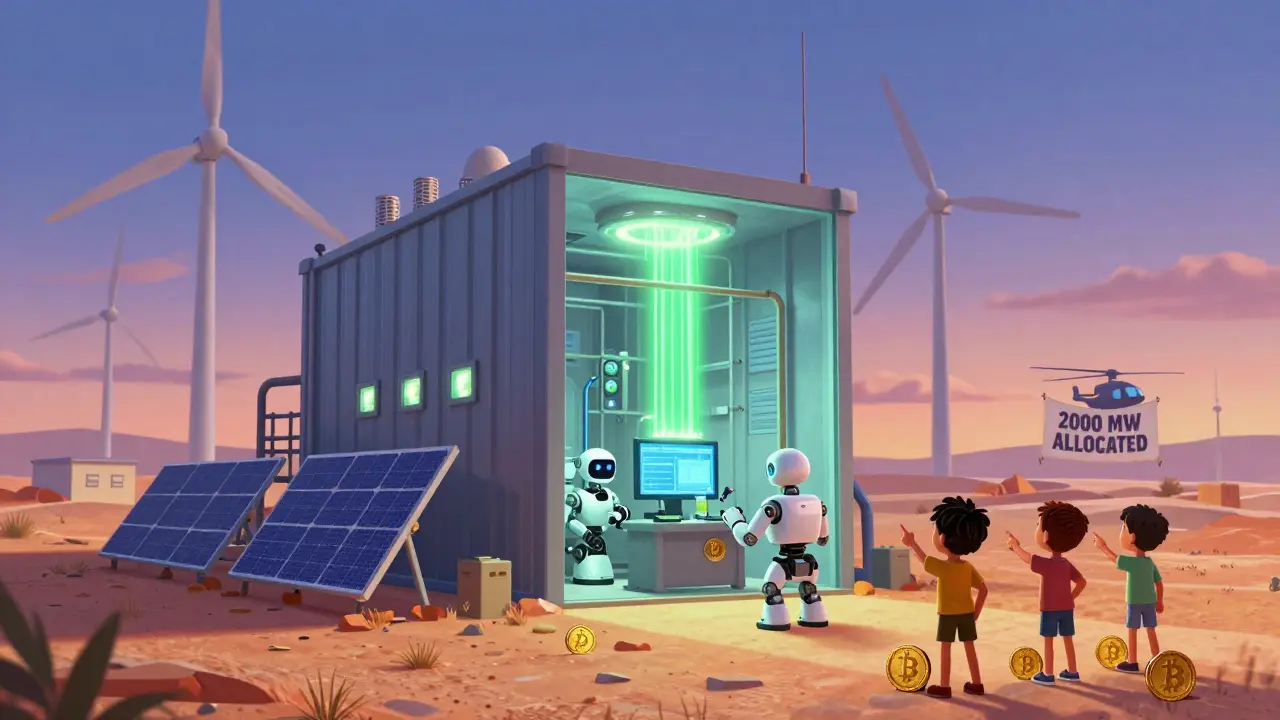

The Energy Angle - Why Pakistan Is Building Crypto Mines

Here’s the twist: while the public is banned from using banks for crypto, the government is quietly investing in mining. In 2025, Pakistan allocated 2,000 megawatts of surplus electricity - enough to power a small country - to Bitcoin mining operations. Why? Because they realized something: crypto isn’t going away. And if they can’t stop it, maybe they can profit from it. Mining uses cheap, underutilized power. It creates jobs. It brings in foreign investment. And it positions Pakistan as a hub for blockchain infrastructure. Some analysts believe the government is preparing to launch a national Bitcoin reserve - a sovereign fund that holds Bitcoin as a strategic asset. If that happens, Pakistan could become the first developing nation to treat crypto as part of its national financial strategy.

The Legal Gray Zone - Still Illegal, But Tolerated

Legally? Crypto is still banned. The State Bank hasn’t lifted its 2018 ban. Banks still block crypto-related transactions. The government still warns people about “financial risks.” But practically? Everyone ignores it. Police don’t raid homes. Courts don’t prosecute traders. The media doesn’t cover crackdowns. The government is stuck. Crack down, and you risk mass unrest. Ignore it, and you let a $300 billion economy grow under your nose. That’s why the real story isn’t about regulation. It’s about adaptation. Pakistan didn’t wait for permission. It created its own system - one that works better than the old one.What’s Next? The Road to Legitimacy

There are signs that change is coming. In late 2025, Pakistan’s Finance Ministry held closed-door talks with blockchain firms from Dubai and Singapore. Discussions included licensing P2P platforms, creating a digital asset registry, and possibly allowing regulated exchanges. One thing is clear: the genie is out of the bottle. Even if the government bans crypto tomorrow, the $300 billion market won’t vanish. It’ll just go underground. And it’ll keep growing. The real question isn’t whether Pakistan will legalize crypto. It’s whether it will lead the world in how a developing nation builds a financial system from scratch - without banks, without permission, and without fear.What This Means for Other Countries

Pakistan’s story isn’t unique. Venezuela, Nigeria, Argentina - all have similar crypto booms. But Pakistan’s scale is unmatched. 40 million people. $300 billion. Zero official support. It proves one thing: when people are desperate enough, they’ll build their own economy. And governments can’t stop that - not with laws, not with bans, not with threats. The lesson? If your country’s currency is falling, your banks are broken, and your government won’t help - crypto isn’t an option. It’s a necessity.Is crypto legal in Pakistan in 2026?

No, crypto is still officially banned by the State Bank of Pakistan. Banks are prohibited from processing crypto-related transactions, and exchanges are not licensed. But in practice, millions of Pakistanis trade crypto daily using peer-to-peer platforms and mobile wallets. The government has not enforced the ban, and there are growing signs it may soon create a regulatory framework.

How do Pakistanis buy Bitcoin if banks block it?

Pakistanis use peer-to-peer (P2P) platforms like Paxful and LocalBitcoins. They send money via Easypaisa or JazzCash - Pakistan’s mobile payment apps - to sellers who then send Bitcoin or USDT to their digital wallets. No bank account is needed. The entire process happens through phone apps and cash transfers, making it nearly impossible for authorities to stop.

Why is USDT so popular in Pakistan?

USDT (Tether) is popular because it’s pegged to the US dollar. With the Pakistani rupee losing value every year, people use USDT as a stable store of value. It’s also used to pay freelancers, send remittances, and buy goods online. Unlike Bitcoin, USDT doesn’t swing wildly in price, making it ideal for everyday use.

How much crypto do Pakistanis trade each year?

Estimates put annual crypto trading volume in Pakistan at over $300 billion as of 2025. This includes both centralized exchange trades (which are blocked) and peer-to-peer transactions (which dominate). The figure is based on transaction data from global platforms, mobile wallet activity, and blockchain analysis. It’s the largest crypto market in South Asia and one of the top three globally.

Is Bitcoin mining legal in Pakistan?

Bitcoin mining is not officially regulated, but the government has allocated 2,000 megawatts of electricity for mining operations - a clear signal of tacit approval. Energy companies are building mining farms in areas with surplus power. While individuals aren’t licensed to mine, large-scale operations are being quietly supported as part of national energy strategy.

Why is Pakistan ranked third in global crypto adoption?

The Global Crypto Adoption Index 2025 ranks Pakistan third based on usage patterns across 151 countries. It measures web traffic, P2P volume, mobile wallet activity, and transaction frequency. Pakistan’s high ranking comes from its massive user base - over 40 million people - and the sheer volume of daily trades, despite having no legal infrastructure. It’s adoption driven by necessity, not convenience.

Can Pakistanis use crypto to send money abroad?

Yes - and it’s one of the main reasons crypto took off. Freelancers, IT workers, and overseas workers use crypto to receive payments from clients in the US, Europe, and the Middle East. Sending money through traditional channels costs 15-20% in fees and takes days. With crypto, they send USDT directly to a wallet in minutes for less than 1% in fees. It’s faster, cheaper, and more reliable.

What are the risks of trading crypto in Pakistan?

The biggest risk is scams. Since there’s no regulation, anyone can set up a fake P2P trade. Buyers can lose money if sellers disappear. There’s no legal recourse. Also, if the government suddenly cracks down, wallets could be frozen or seized. Users are advised to use escrow services, avoid large cash trades, and store crypto in hardware wallets - not on phones or apps.

Will Pakistan create its own digital currency?

There are rumors the government is exploring a central bank digital currency (CBDC), but no official plans exist. Most experts believe the real path forward is regulating crypto - not replacing it. Pakistan’s massive crypto ecosystem is too big to ignore. The government is more likely to license exchanges and tax transactions than launch a competing digital rupee.

How does Pakistan’s crypto market compare to India’s?

India leads in total users, with over 100 million crypto holders. But Pakistan leads in trading volume per capita and P2P activity. India has licensed exchanges and clearer regulations, while Pakistan’s market is entirely underground. India’s volume is mostly on centralized platforms. Pakistan’s is mostly cash-based, peer-to-peer, and driven by survival - not speculation.

What’s happening in Pakistan isn’t a glitch in the system. It’s the system working - even when it’s broken. The $300 billion in crypto trading isn’t a number on a chart. It’s millions of people choosing freedom over fear. And that’s something no law can undo.

Write a comment