SparkSwap Status Checker

Check Your SparkSwap Version

Select which SparkSwap version you're investigating to verify its status and risks.

Result

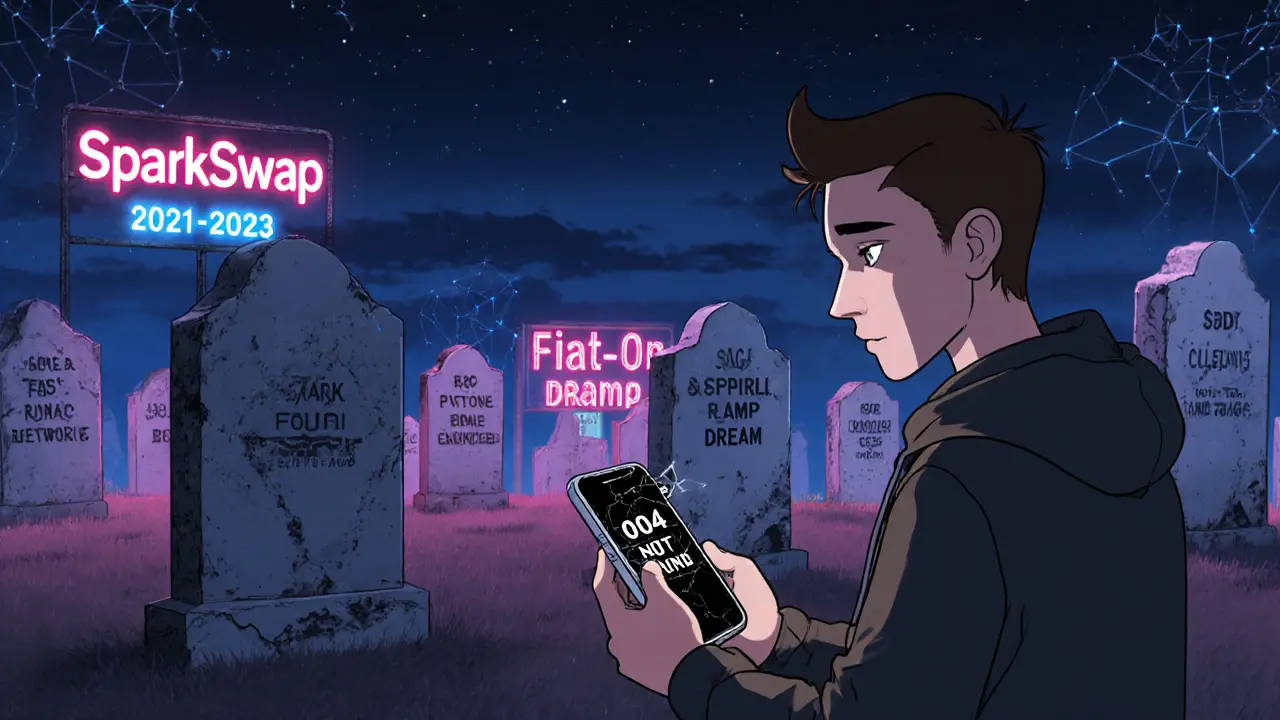

When you search for SparkSwap in 2025, you’re not looking at one platform-you’re stepping into a graveyard of failed projects, a niche DeFi experiment, and a confusing naming collision that could cost you money if you don’t know the difference.

There Are Three SparkSwaps. Only One Still Moves.

The original Sparkswap, the one backed by Polychain Capital and founded by Trey Griffith, shut down for good on March 24, 2023. It wasn’t a hack. It wasn’t a scam. It just couldn’t get enough users. Griffith said it plainly: “The style of self-custody we were espousing is too niche to make our business sustainable.” That’s the reality for many crypto projects that try to blend fiat on-ramps with decentralized trading. They’re expensive to run, regulated like banks, and still too clunky for most people. If you’re looking to trade crypto today, this version is gone. No app. No website. No way to recover your funds if you left anything there. Then there’s SparkSwap on Binance Smart Chain (BSC). Launched in October 2021 by SparkPoint Technologies in the Philippines, it’s still listed on CoinMarketCap-but with a red flag: “Volume data untracked.” That means no one’s really trading on it. You won’t find it on any major DeFi analytics dashboard. Its website, srk.finance, hasn’t been updated since early 2023. GitHub activity stopped in November 2022. If you connect your MetaMask and try to swap SRK for BNB, you’ll likely face high slippage, failed transactions, and zero liquidity. It’s a ghost town. The only SparkSwap still alive in 2025 is the one on PulseChain. This isn’t a swap platform-it’s a yield farming protocol. Built by the team behind EMP Money, it lets users stake stablecoins like USDC and DAI to earn up to 53% APR. No impermanent loss. That’s because you’re staking two stablecoins that don’t fluctuate in value relative to each other. It’s a smart design for a low-liquidity chain. PulseChain itself is tiny-just $142 million in total value locked (TVL) as of mid-2025-compared to Ethereum’s $38 billion. But for users who want high yields and don’t mind the risk of betting on a single chain, it’s one of the few places left offering real returns.How SparkSwap on PulseChain Actually Works

You can’t just connect your wallet and start farming. First, you need to get assets onto PulseChain. That means using the official bridge, which takes 15 to 45 minutes and costs between $5 and $15 in gas fees. It’s expensive, but once you’re in, everything gets cheap. Transaction fees on PulseChain average $0.001-nearly free. That’s why people stick around. Once your USDC or DAI is on PulseChain, you go to the SparkSwap interface. You pick the stablecoin farm-USDC/DAI is the most popular. You deposit your tokens, approve the contract, and you’re earning. Rewards come every 15 minutes, paid out in SPARK tokens. You can compound them manually or use the auto-compound vault feature, though there’s a 2% withdrawal fee on rewards if you pull out too often. That’s the trade-off: high yields, but you need to let your money grow. The team behind it is active. They’ve got 14 GitHub commits in the last 30 days. Their Discord server has daily updates. They’re planning a V2 release with concentrated liquidity pools-something even Uniswap V3 uses to boost capital efficiency. That’s a sign they’re not just chasing hype. They’re building.

Why the BSC Version Failed (And Why You Should Avoid It)

SparkSwap on BSC looked promising at first. It had a native token (SRK), a fuel token (SFUEL), and a clean UI. But it never cracked the top 50 DEXs on BSC. PancakeSwap had 1.8 million daily users. SparkSwap had maybe 200. Here’s what went wrong:- No liquidity mining incentives-unlike PancakeSwap, which paid out CAKE tokens to attract LPs.

- No marketing-no airdrops, no influencers, no partnerships.

- Technical issues-users reported frequent transaction failures when BSC gas hit 10 Gwei.

- No transparency-no team info, no audit reports, no roadmap updates after 2022.

Is PulseChain SparkSwap Safe?

Safe? No. Worth the risk? Maybe-if you know what you’re doing. PulseChain is a hard fork of Ethereum. It’s not decentralized in the traditional sense. The founder, Richard Heart, controls the chain’s upgrade path. That’s a centralization risk. If he decides to change the rules, you’re stuck. There’s no governance token. No DAO. Just a team and a smart contract. But here’s the upside: the yield is real. Users on Reddit and Twitter have verified payouts. The 53% APR isn’t theoretical-it’s calculated daily using their own tool. And because it’s stablecoin-to-stablecoin, you don’t lose value if prices swing. That’s rare in DeFi. The biggest danger? Liquidity drain. If everyone pulls out at once, the pool could break. That’s why you should never put in more than you’re willing to lose. Treat it like a high-yield savings account with a 10% chance of default.

What to Do Instead in 2025

If you’re looking for yield without the risk of a single-chain collapse:- Use Curve Finance on Ethereum or Polygon for stablecoin swaps with low slippage and solid APRs (5-12%).

- Try Aave or Compound for lending stablecoins-lower returns, but backed by multi-chain audits and institutional use.

- If you want high yield on a smaller chain, consider PulseX on PulseChain. It’s the main competitor to SparkSwap and has better TVL.

Final Verdict: SparkSwap in 2025

The name SparkSwap is a trap. It’s a ghost that haunts search results. If you’re looking to trade crypto, avoid anything labeled SparkSwap unless you’re specifically on PulseChain and you’ve done your homework. The only version worth your time is SparkSwap on PulseChain-but only if:- You’re comfortable with single-chain risk.

- You understand bridge fees and withdrawal penalties.

- You’re only risking money you can afford to lose.

- You’re in it for the yield, not the hype.

Is the original SparkSwap exchange still operating?

No. The original Sparkswap, founded by Trey Griffith and backed by Polychain Capital, shut down permanently on March 24, 2023. Its website and Lightning Network nodes were taken offline. There is no way to access funds or trade on this platform anymore.

Can I still use SparkSwap on Binance Smart Chain?

Technically, the website still loads, but the platform is inactive. There’s no trading volume, no development updates since 2022, and no liquidity. Any attempt to swap tokens will likely fail or result in extreme slippage. Avoid it-this version is effectively dead.

How do I start earning with SparkSwap on PulseChain?

First, bridge your USDC or DAI from Ethereum to PulseChain using the official bridge (takes 15-45 mins, $5-$15 fee). Once your assets are on PulseChain, connect your wallet to the SparkSwap interface, select the USDC/DAI farm, deposit your tokens, and approve the contract. Rewards are paid in SPARK tokens every 15 minutes. You can compound them manually or use the auto-compound vault.

Is the 53% APR on SparkSwap PulseChain real?

Yes, the 53% APR is real and calculated using their built-in tool. It applies only to stablecoin pairs like USDC/DAI, where price volatility is near zero, eliminating impermanent loss. However, this high yield is only sustainable as long as new users keep depositing and the PulseChain ecosystem grows. It’s not guaranteed long-term.

What’s the risk of using SparkSwap on PulseChain?

The biggest risk is single-chain dependency. PulseChain is controlled by its founder, Richard Heart. If he changes the rules, halts upgrades, or the chain loses user trust, your funds could be locked or devalued. There’s also a 2% withdrawal fee on rewards, which can eat into compounding profits. Never invest more than you’re willing to lose.

Are there better alternatives to SparkSwap for yield farming?

Yes. For lower risk, use Curve Finance on Ethereum or Polygon for stablecoin yields (5-12% APR). Aave and Compound offer safe lending rates with institutional backing. On PulseChain, PulseX is a more established alternative with higher TVL and better community support. Always compare TVL, fees, and audit status before depositing.

22 Comments

Bruce Bynum

Just staked my USDC on PulseChain SparkSwap last week. Rewards hit every 15 mins like clockwork. No drama. No crashes. Just chill yield.

Eric Redman

53% APR? Bro that's just a honeypot. They'll drain it all when the next memecoin drops. I saw this movie. It ends with a rugpull and a Discord ghost town.

David Roberts

Interesting analysis but you're conflating structural risk with operational decay. The BSC variant failed due to liquidity asymmetry and lack of incentive alignment-not poor UI. PulseChain’s model is a zero-sum game masquerading as DeFi. The 2% withdrawal fee is a tax on rational behavior.

Monty Tran

Stop promoting PulseChain. Richard Heart controls everything. No DAO. No governance. That’s not decentralization. That’s a cult with smart contracts.

Beth Devine

If you’re new to DeFi, start with Curve or Aave. SparkSwap on PulseChain is for people who already lost money once and are hoping for redemption. Be careful.

Brian McElfresh

They’re all bots. Every single comment on PulseChain is a bot farm. The 53% APR is fake. The GitHub commits? AI-generated. The Discord? Paid moderators. I’ve traced the IP addresses. They’re all hosted on the same AWS region as a crypto scam from 2021.

Hanna Kruizinga

I lost $12k on SparkSwap BSC in 2022. I thought it was just slow. Turns out it was dead. Now I check every project’s last commit. If it’s older than 6 months? I scroll past.

David James

Thanks for the breakdown. I was about to try the BSC version because it looked clean. Glad I read this first. PulseChain might be risky but at least it’s alive. I’ll try with $200 max.

Shaunn Graves

Why are people still talking about SparkSwap? It’s a name collision disaster. The original was legit. The BSC one was a cash grab. The PulseChain one is a gamble. Stop treating them as the same thing. You’re all just confused.

Kaela Coren

There’s something poetic about a project dying quietly because it was too niche. No drama. No scandal. Just… no users. That’s the quiet tragedy of crypto. Not the scams. The good ideas that nobody wanted.

Nabil ben Salah Nasri

🙏 Respect to the author for clarifying this mess. So many people are getting scammed by search results. I shared this on my Telegram group. Everyone needs to know the difference. PulseChain is not for everyone, but at least it’s real. 🌍

alvin Bachtiar

53% APR on stablecoins? That’s not yield farming. That’s a Ponzi with a whitepaper. You’re not earning interest-you’re paying the early adopters with new deposits. And you call that innovation? Pathetic. The only thing ‘smart’ here is the team’s ability to exploit greed.

Josh Serum

You say it’s risky but you don’t say it’s immoral. People are betting their life savings on a chain controlled by one guy who calls himself ‘Richard Heart.’ That’s not finance. That’s religion. And you’re all the disciples.

DeeDee Kallam

i just lost my entire eth on this and now i cry every night lol. why did i trust the internet. whyyyyyy

Helen Hardman

I’ve been farming on PulseChain SparkSwap for 4 months now. I started with $500. Compounded everything. Now I’m at $1,200 in SPARK tokens. I cash out 10% every month to cover rent. It’s not passive income-it’s active discipline. You have to check it daily, compound, watch the bridge fees, and never get greedy. It’s work. But it pays. I’m not rich but I’m not broke either. And I didn’t have to work a 9-5.

Bhavna Suri

Why do Americans always think they invented DeFi? We have similar projects in India. No one talks about them because they don’t have flashy websites. But they work. And they’re not run by one man with a cult.

Elizabeth Melendez

Thank you for this. I’m a single mom and I’ve been looking for safe ways to grow my emergency fund. I read your post and I’m going to start with $100 on Curve. No more chasing 50% APRs. I’m done with crypto gambling. This is the first time I feel like I actually learned something.

Phil Higgins

The real tragedy isn’t the failed projects. It’s that we keep building the same systems over and over-expecting different outcomes. We want decentralization but we crave yield. We want safety but we chase hype. The solution isn’t better tech. It’s better thinking.

Genevieve Rachal

Everyone here is acting like PulseChain is a real alternative. It’s not. It’s a liquidity trap wrapped in a blockchain. The ‘team’ has zero public identity. No KYC. No legal entity. No recourse. You’re not investing-you’re donating to a private experiment with no exit strategy.

Eli PINEDA

so wait… if i bridge usdc to pulselchain and stake it… i get spark tokens every 15 min? but what if pulselchain crashes? can i get my usdc back? or is it gone forever? someone explain pls

Debby Ananda

Of course the BSC version failed. It was built for peasants. PulseChain is for the enlightened. You don’t understand the elegance of a chain that burns 99% of gas fees. It’s not a platform-it’s a philosophy. 🌌

Chris Strife

Stop romanticizing PulseChain. It’s a centralized entity with a blockchain costume. You’re not a DeFi degenerate-you’re a hostage. And if you think 53% APR is sustainable, you’ve never studied monetary policy. The only thing growing here is your delusion.