DeFi Yield Farming: How to Earn Crypto Rewards with Liquidity Pools

When you hear DeFi yield farming, a way to earn passive income in decentralized finance by providing liquidity to crypto protocols. Also known as liquidity mining, it’s not magic—it’s math. You lock your crypto into a smart contract, and in return, you get rewards paid in tokens, often from the protocol itself or trading fees. It’s how regular people turned $500 into $2,000 during the 2020 DeFi boom—not by guessing prices, but by lending what they already owned.

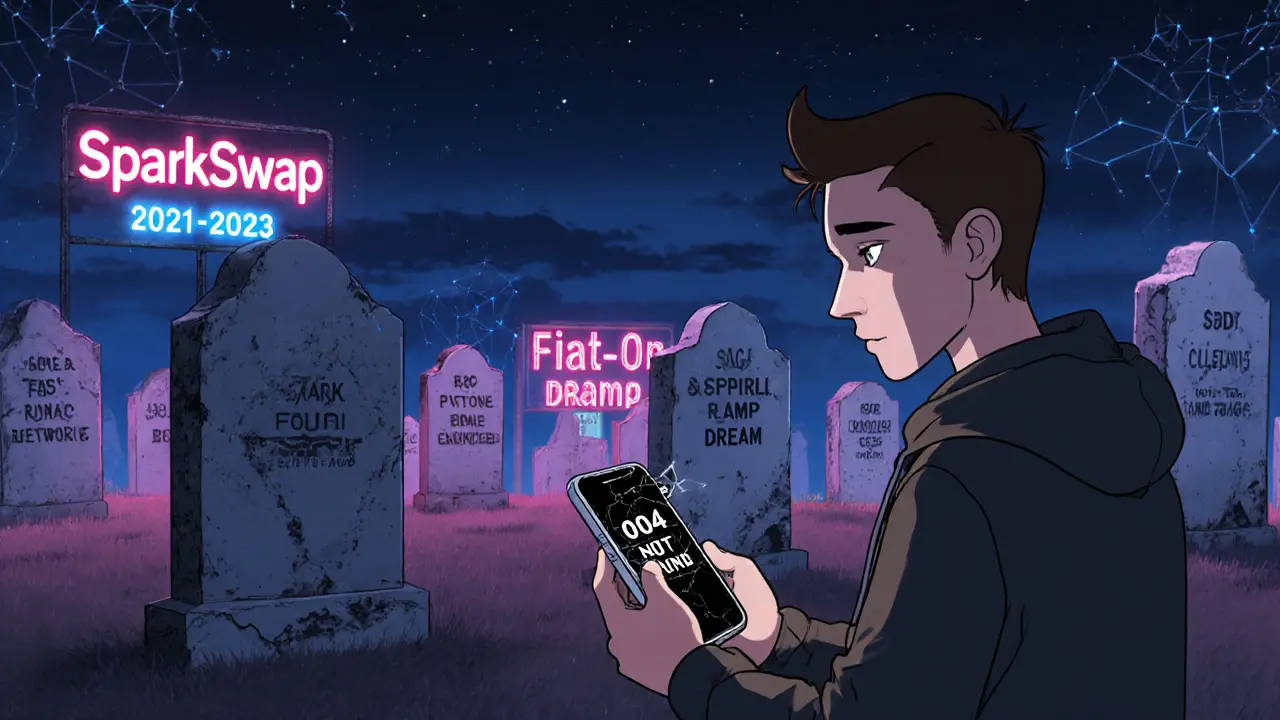

Yield farming relies on three key pieces: liquidity pools, smart contract-based markets where users deposit pairs of tokens to enable trading, staking, locking tokens to support network security and earn rewards, and crypto rewards, tokens distributed by protocols to incentivize participation. These aren’t just buzzwords—they’re the gears that turn the system. For example, WOOFi lets you farm rewards by swapping tokens across chains, while Sovryn lets you earn SOV by locking BTC-backed assets. But here’s the catch: high rewards often mean high risk. Some farms collapse overnight. Others are outright scams. The ones that last? They’re built on real usage, not hype.

You’ll find posts here that show you exactly how people got locked out of RACA airdrops because they used the wrong wallet, or how Lunar Crystal’s "free NFT" turned into nothing. You’ll see why DOGE-themed tokens are red flags, and how WMTon’s tokenized stock model works under the hood. We cover the tools, the traps, and the real strategies used by traders who didn’t lose everything. No fluff. No promises of instant riches. Just what works, what doesn’t, and what to watch out for next.