For years, owning Bitcoin or Ethereum in Pakistan was a legal gray zone - not officially illegal, but banks refused to touch it, exchanges shut down, and users operated in the shadows. That changed in 2025. On September 3, Pakistan flipped the script: cryptocurrency went from banned to legally recognized, but not how most people expected.

From Ban to Blueprint: The 2025 Shift

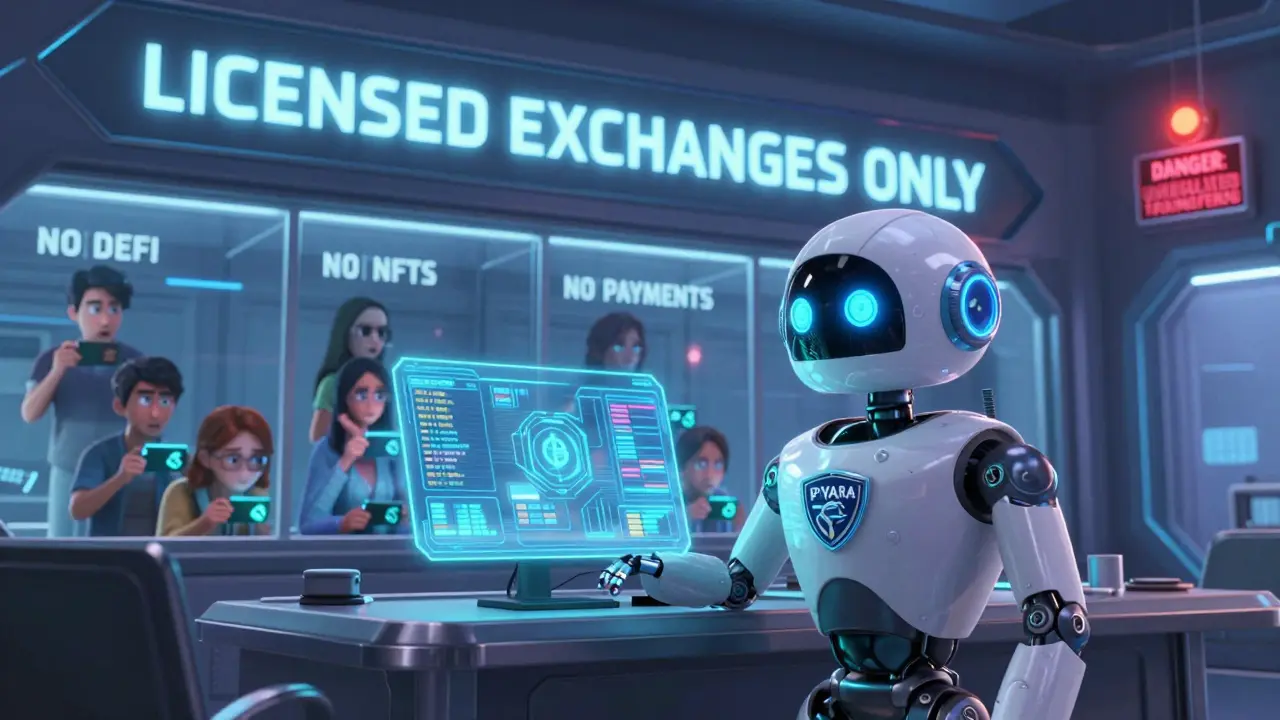

In 2018, the State Bank of Pakistan (SBP) told banks to cut off all crypto-related transactions. The message was clear: don’t touch it. But underground markets kept growing. By 2024, an estimated $21 billion in crypto was moving through Pakistan - remittances, peer-to-peer trades, and informal investments - all outside the system. The government couldn’t ignore it anymore. The turning point came in September 2025. Dr. Inayat Hussain, Acting Deputy Governor of SBP, stood before the Senate and announced the bank would formally withdraw its 2018 ban. The reason? A new law: the Virtual Assets Bill 2025. Signed into ordinance by President Asif Ali Zardari on July 8, 2025, this bill didn’t just legalize crypto - it created a new regulator to control it. Enter PVARA: the Pakistan Virtual Asset Regulatory Authority. This isn’t a advisory body. It’s a full-power regulator with the ability to license, audit, and shut down crypto businesses. It answers directly to the Finance Ministry and works alongside SECP, SBP, and the Ministry of IT. Its job? Make sure crypto doesn’t run wild.What’s Actually Legal Now?

Here’s the catch: you can now legally hold Bitcoin, Ethereum, and other coins. You can send them to someone else. You can buy them with Pakistani rupees through licensed exchanges. That’s it. You cannot use crypto to pay for groceries, phone bills, or ride-hailing apps. You cannot trade altcoins on open exchanges. You cannot invest in crypto funds or ETFs. The government isn’t banning crypto - it’s boxing it in. The only real freedom? Holding and transferring. Everything else is blocked unless it’s approved by PVARA. That means no decentralized finance (DeFi), no NFT marketplaces, no crypto lending platforms - not yet, maybe never.The Digital Pakistani Rupee: State Control, Not Crypto Freedom

While private crypto got limited legal status, the government launched its own digital currency: the Digital Pakistani Rupee (Digital PKR). This isn’t Bitcoin. It’s not even like Ethereum. It’s a Central Bank Digital Currency (CBDC) - fully controlled by the State Bank. Think of it like mobile money, but on blockchain tech. You can send Digital PKR to anyone with a registered wallet. Transactions are instant. No fees. But here’s the key: the government sees every transaction. They can freeze accounts. They can track spending patterns. They can even set limits on how much you can transfer per day. This isn’t about innovation. It’s about control. The SBP wants to replace cash and reduce reliance on foreign remittances - not empower individuals. The Digital PKR is designed to be the only digital money most Pakistanis ever use.

How Pakistan Compares to the Rest of the World

Pakistan’s approach doesn’t fit neatly into global categories. - In El Salvador, Bitcoin is legal tender. You can buy coffee with it. In Pakistan? You can’t even buy a SIM card with Bitcoin. - In the U.S., you can trade crypto on Coinbase, invest in crypto ETFs, and use crypto debit cards. In Pakistan? Only licensed exchanges are allowed - and they can’t offer trading beyond buying/selling. - In India, crypto is taxed heavily but fully legal for trading. In Pakistan, trading is restricted to approved platforms with strict KYC. - In the UAE, crypto hubs like Dubai offer licenses to global exchanges. Pakistan’s PVARA is focused on domestic compliance, not attracting international firms. The closest model? China. Both countries ban private crypto use for payments and commerce, while building state-controlled digital currencies. But unlike China, Pakistan allows citizens to hold crypto - just not use it.Who Benefits? Who Gets Left Behind?

The government says this move will bring the $21 billion crypto economy into the formal system. That means more tax revenue, better data on remittances, and fewer underground transactions. It also means foreign investors might finally feel safe putting money into Pakistan’s fintech sector. But who’s really winning? - Large remittance companies - They’re already partnering with PVARA to use crypto for cross-border transfers. This could cut fees and speed up payments from the Gulf and Europe. - State-controlled fintech startups - If they get a license, they can build apps around Digital PKR and regulated crypto transfers. - Traditional banks - They’re no longer afraid of crypto. Now they can offer custody services and compliance tools. Who’s losing? - Everyday crypto users - Many bought Bitcoin to protect savings from inflation. Now they can’t spend it. They can’t earn interest on it. They’re stuck holding it like a savings bond with no return. - Developers and innovators - No DeFi, no NFTs, no Web3 projects. Pakistan could’ve become a regional tech hub. Instead, it’s building a walled garden. - Small remittance users - If the only legal way to send crypto is through licensed providers, fees may stay high. The promise of cheaper transfers might not materialize.

24 Comments

Sammy Tam

So they legalized crypto but only so you can hold it like a dusty collectible? Feels like giving someone a Ferrari key but locking the garage and taking away the gas station.

Meanwhile, the Digital PKR is basically a surveillance tool with a blockchain sticker on it. Real progress? Nah. Just a new cage with nicer bars.

Abby Daguindal

Wow. Just wow. This isn’t regulation-it’s crypto euthanasia. They didn’t legalize Bitcoin, they buried it alive and called it a policy win.

Heather Turnbow

The structural tension here is profound. On one hand, the government acknowledges the economic reality of a $21 billion underground market. On the other, it chooses control over empowerment, prioritizing state sovereignty over individual financial autonomy.

This is not innovation-it’s institutional containment. The Digital PKR is not a tool of inclusion; it is a mechanism of observation. And while remittance companies benefit, the average citizen is left with a digital artifact, not a currency.

Jesse Messiah

Man, this is wild. They made it legal to own crypto but not to do anything with it? That’s like saying you can have a guitar but can’t pluck the strings.

Still, props to the gov for finally admitting the underground economy exists. Now if only they’d let people use it to pay for chai instead of just staring at their wallets.

Rebecca Kotnik

The psychological and sociological implications of this regulatory framework are deeply concerning. The state’s decision to permit the mere holding of cryptocurrency while prohibiting all meaningful utility effectively transforms digital assets into non-productive reserves.

This policy does not foster financial inclusion; it institutionalizes financial impotence. Citizens are granted symbolic ownership without functional agency, reinforcing a dynamic of passive compliance rather than active participation. The Digital PKR, while technologically sophisticated, functions as a mechanism of centralized behavioral control, eroding the foundational principles of decentralized finance not through prohibition, but through suffocation by design.

It is not a revolution. It is a reclamation.

Terrance Alan

They’re not regulating crypto they’re weaponizing it. Every transaction tracked. Every wallet monitored. The Digital PKR isn’t money-it’s a leash with a GPS chip.

And don’t tell me this is about fraud prevention. They banned DeFi because they can’t control it. They banned NFTs because they can’t tax them. This isn’t progress-it’s panic dressed up as policy.

They think they’re smart. But they just made crypto a museum exhibit.

Jonny Cena

Look, I get why they did this. The underground economy was out of control, and remittances were slipping through the cracks. The Digital PKR could actually help millions who never had bank accounts.

Yeah, it’s not the freedom we dreamed of-but sometimes progress isn’t flashy. It’s quiet. It’s slow. It’s about giving people a safe way to send money home, even if they can’t buy a Lamborghini with it yet.

Let’s not throw the baby out with the blockchain.

Kayla Murphy

Okay but imagine if this was the spark? What if this tight control is just Phase 1? Maybe in 2027 they let you pay for Netflix with crypto. In 2029, you can buy a phone with Bitcoin. In 2031, DeFi gets a pilot in Karachi.

They’re not killing crypto-they’re putting it in a greenhouse. Give it time. Growth takes patience.

Florence Maail

They’re using crypto to track us. Mark my words. This is the Fed’s playbook. The Digital PKR? It’s the first step to a social credit system. You spend too much on tea? Your wallet gets locked. Buy crypto on the side? You’re flagged.

And don’t even get me started on the ‘licensed exchanges’-they’re all owned by the same people who run the banks. It’s all connected. They want your money. And your data. And your soul.

100% mind control. 🤖💸

Chevy Guy

So they made crypto legal but only if you don't use it. Classic. Next they'll legalize air but only if you don't breathe it.

Meanwhile the Digital PKR is just a blockchain version of a paper receipt you can't spend. I'm not surprised. Pakistan's version of innovation is renaming the problem and calling it a solution.

They didn't embrace crypto. They buried it with paperwork.

Amy Copeland

How quaint. A developing nation thinks it can replicate China’s financial authoritarianism and call it ‘progress.’

Let me guess-next they’ll mandate crypto wallets be linked to national ID cards and require monthly compliance seminars. How progressive. How utterly, depressingly predictable.

Patricia Amarante

So you can own it but not spend it? That’s like being allowed to have a pet dragon… but not feed it. Kinda sad, honestly.

Timothy Slazyk

This isn’t a crypto policy-it’s a monetary sovereignty play. The State Bank isn’t trying to democratize finance; it’s trying to eliminate the middlemen who bypassed them. The $21 billion flow was a threat to their control. Now they’ve built a firewall around it.

But here’s the real question: can a CBDC that tracks every penny survive in a society where cash still dominates? Or will this become the world’s most expensive ledger, collecting dust while people use hawala networks anyway?

They’ve created a system that looks modern on paper but is still rooted in 19th-century control. The tech is 21st century. The mindset? Still colonial.

Madhavi Shyam

Regulatory sandbox with KYC-AML compliance stack integrated with SBP’s core banking API via PVARA’s tokenized settlement layer-this is institutional fintech architecture at scale. The Digital PKR is a sovereign DLT implementation with real-time audit trails. Not crypto liberation-monetary governance.

Mark Cook

Wait, so you can own Bitcoin but can’t buy a burger with it? Then what’s the point? Why not just give people gold coins and call it a day?

Also, who voted for this? Did anyone even ask the people? Or did some guy in Islamabad just decide crypto was ‘too chaotic’?

Jack Daniels

I don’t even want to think about this anymore. Just let me hold my Bitcoin in peace. I don’t care if they track me. I just want my bag to be safe.

Bradley Cassidy

so like… you can have crypto but cant do anything with it?? that’s wild. like owning a car but the keys are in a vault. and the digital rupee thing? sounds like they’re building a big brother app but with more blockchain buzzwords.

still, at least they stopped pretending it’s illegal. progress? kinda. but also kinda sad.

Samantha West

The state’s intervention here represents a paradox of modern governance: the simultaneous recognition of decentralized systems and the insistence on centralized control.

The Virtual Assets Bill 2025 is not a legal framework-it is a declaration of epistemological dominance. The Digital PKR is not a currency-it is a manifestation of the state’s claim over the ontological nature of value itself.

And yet, the people still hold Bitcoin. And in that quiet act of possession, there is resistance.

Craig Nikonov

China 2.0. They banned crypto payments, built a digital currency, and now they’re pretending this is innovation. Wake up. This isn’t progress-it’s digital authoritarianism with a startup vibe.

And the fact that they’re letting people hold crypto? That’s just to make the surveillance feel less oppressive. Like giving a prisoner a phone… but only if they use it to call the prison office.

Donna Goines

They’re using crypto to track everyone. The Digital PKR is just the beginning. Next thing you know, your wallet gets frozen if you buy too much rice or your kid watches too many YouTube videos. This is how dictatorships start. With ‘convenient’ digital money.

They say it’s for remittances. Bullshit. It’s for control. I’ve seen this movie before. And the ending is never good.

Sean Kerr

Okay but this is actually kinda brilliant?? Like, yeah, you can’t use crypto to buy stuff yet-but now you can do it legally. No more shady P2P dodging banks. And the Digital PKR? Could be a game-changer for rural folks who’ve never had a bank account.

They’re not killing crypto-they’re giving it a safe nursery. Let it grow before they let it run wild.

Patience, my friends. This ain’t the end. It’s the warm-up.

Sally Valdez

Of course Pakistan wants to copy China. They’ve always hated freedom. Crypto was supposed to be the people’s money-but now the state owns it. Great. Just great.

Next they’ll ban VPNs and call it ‘cybersecurity.’ Then they’ll say Bitcoin is ‘unpatriotic.’

They didn’t legalize crypto. They kidnapped it.

Elvis Lam

Let’s cut through the noise. The $21 billion in crypto flows was a massive leak in Pakistan’s financial system. The SBP didn’t want to lose control. So they built a dam. The Digital PKR isn’t a threat to Bitcoin-it’s a replacement strategy.

They’re not afraid of crypto. They’re afraid of losing monetary sovereignty. This move is smart, cold, and calculated. And honestly? If I were running the SBP, I’d do the same.

Sammy Tam

Wait till the first hacker cracks PVARA’s system and leaks everyone’s Digital PKR spending history. Then we’ll see how ‘secure’ this whole thing really is.

And when that happens, people will realize: the only thing more dangerous than unregulated crypto… is regulated crypto with a single point of failure.