Imagine you own Bitcoin, and its value has gone up 300% over the last year. You need cash to pay for a new car, home renovation, or even to invest in another asset-but you don’t want to sell your Bitcoin because you believe it will keep rising. This is where crypto borrowing comes in. Instead of selling your digital assets, you use them as crypto collateral to get a loan in fiat currency like USD or EUR. It’s not magic. It’s finance, reimagined for the blockchain era.

How Crypto Borrowing Actually Works

Crypto borrowing isn’t like getting a personal loan from your bank. There’s no credit score check. No income verification. Instead, the system relies on one thing: the value of the cryptocurrency you lock up as collateral. When you borrow against your Bitcoin or Ethereum, the platform holds onto it in a secure wallet. In return, you get cash-usually within 24 to 72 hours. The amount you can borrow depends on something called the loan-to-value (LTV) ratio.Most platforms let you borrow between 50% and 90% of your collateral’s value. For example, if you deposit $10,000 worth of Ethereum, you might be able to borrow $7,000. That’s a 70% LTV. Some platforms like Nexo offer up to 97% LTV, but those come with higher risks. Why? Because if the price of your collateral drops suddenly, the platform can automatically sell part or all of it to cover the loan. This is called liquidation.

Interest rates vary depending on the asset and the platform. Stablecoins like USDC or DAI usually have lower rates-around 5% to 12% APR-because they don’t swing in price. Bitcoin and Ethereum? Those can cost you 10% to 20% APR, especially during volatile markets. Some DeFi platforms even charge variable rates that change every few minutes based on how much demand there is for borrowing.

Three Ways to Borrow Against Crypto

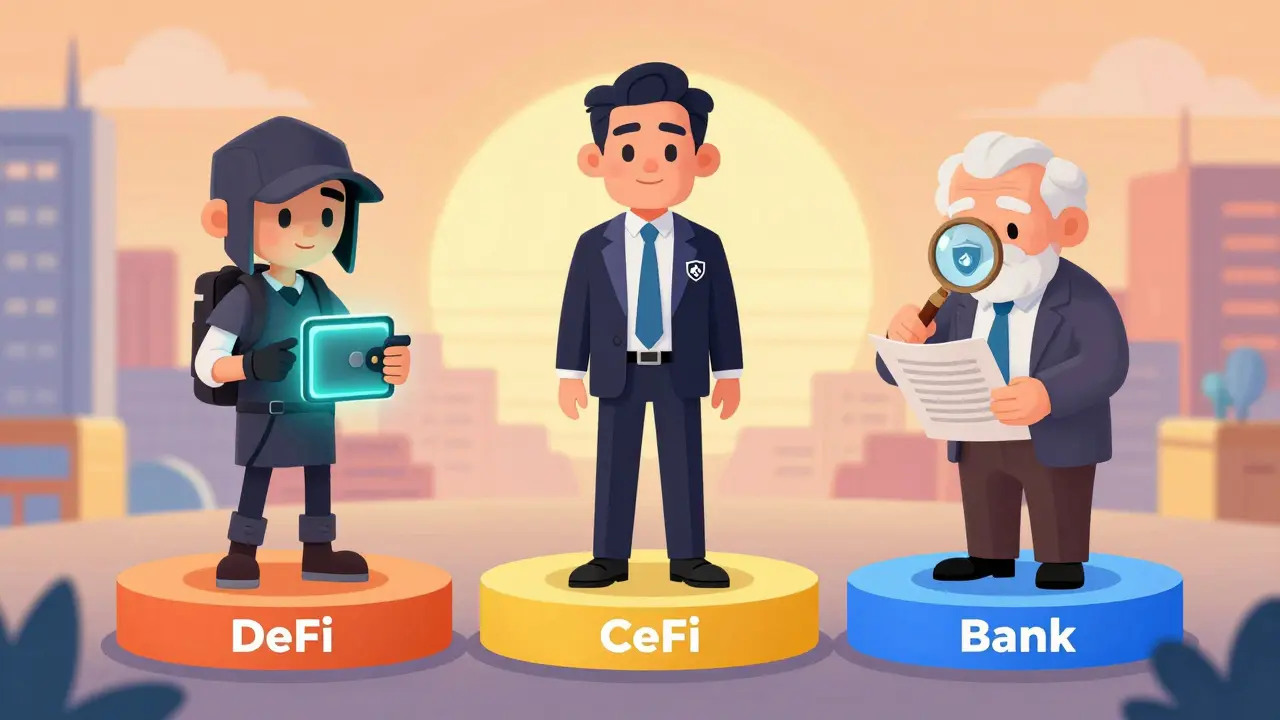

There are three main paths to get a crypto-backed loan, and each has trade-offs.- DeFi (Decentralized Finance): Platforms like Aave and Compound run on smart contracts on the Ethereum blockchain. You don’t need to give your identity. No KYC. You interact directly with code. But if the smart contract has a bug, or if the network gets congested, you could lose access to your funds. These platforms typically allow LTVs of 50% to 75% and are best for users comfortable with wallets, gas fees, and technical risks.

- CeFi (Centralized Finance): Think of these as crypto banks: Coinbase, Kraken, and (before it collapsed) Celsius. They offer user-friendly apps, customer support, and higher LTVs-sometimes up to 97%. But here’s the catch: you’re trusting a company with your assets. In 2022, over 2 million users lost access to their funds when Celsius, Voyager, and BlockFi froze withdrawals. These platforms often promise fixed rates that seem too good to be true-and sometimes they are.

- Traditional Banks: Swiss bank Sygnum, German neobank Solaris, and even UBS now offer crypto-backed loans. These are conservative. LTVs are usually capped at 50% to 60%. You’ll go through full KYC, and the process can take weeks. But if you’re an institutional investor or someone who needs regulatory safety, this is the safest option. They treat crypto like gold or bonds-something to be managed carefully.

What Happens When the Market Drops?

This is where most people get caught off guard. Crypto prices swing fast. In May 2021, Ethereum dropped 50% in just three days. In June 2022, it fell 60% in a week. If your collateral value dips below the platform’s maintenance threshold-say, 110% to 150% of your loan-you’ll get a margin call. That means you have to add more collateral or pay back part of the loan. If you don’t respond in time? The system sells your crypto automatically.One user on Reddit lost $45,000 worth of Bitcoin after a 12-hour outage on a CeFi platform. The price crashed during the downtime. When the system came back online, it liquidated his entire position because the LTV had spiked past the danger zone. He never got a warning email. No phone call. Just a notification that his assets were gone.

Experts recommend keeping your LTV at least 20% below the platform’s maximum. So if the max is 70%, aim for 50%. That gives you a buffer. Set up price alerts. Use automated tools. And never borrow the maximum possible-especially if you’re not watching the market daily.

Legal and Tax Risks You Can’t Ignore

In the U.S., the IRS treats crypto as property, not currency. So if you sell it, you owe capital gains tax. But if you borrow against it? You don’t trigger a taxable event. That’s why many investors use crypto loans instead of selling. But that doesn’t mean you’re off the hook.Some countries, like Germany and Japan, treat crypto loans as non-taxable. Others, like the UK and Australia, are still figuring it out. And if the platform you’re using goes bankrupt? Your crypto might be treated as part of the company’s assets-not yours. In 2022, courts in the U.S. and EU struggled to determine whether crypto held by Celsius was customer property or company property. The answer? It depended on the fine print in the user agreement.

Legal experts warn that even if a platform holds your private keys, you might still be liable if someone else accesses them. There’s no clear legal framework yet. The EU’s MiCAR regulation, which took effect in 2024, is the first major attempt to standardize this. But in the U.S., it’s still a patchwork of state laws.

Who’s Using This-and Why?

Most crypto borrowers are between 25 and 44 years old. They’re not speculators. They’re entrepreneurs, freelancers, and investors who already hold crypto and need liquidity without losing their upside. Institutional investors use it too. Hedge funds borrow against Bitcoin to fund trading strategies. Real estate firms use crypto loans to cover short-term cash gaps while waiting for property sales to close.According to CoinShares, institutional clients make up only 4% of users-but they account for 31% of all loan volume. That’s because they borrow millions at a time. One firm in Singapore used a $2 million Bitcoin position to secure a $1.4 million loan to buy a commercial property. They didn’t sell their Bitcoin. They kept it. And when Bitcoin rose 40% six months later, they made a profit on both the property and the crypto.

Getting Started: What You Need to Know

If you’re new to this, here’s how to begin:- Choose your platform wisely. If you’re inexperienced, start with Coinbase or Kraken. Avoid DeFi unless you’ve used MetaMask before.

- Deposit only what you can afford to lose. Never borrow more than 50% of your portfolio’s value.

- Set up price alerts. Use apps like CoinGecko or CoinMarketCap to get notified when your collateral drops 10%.

- Know the liquidation trigger. Check your platform’s terms. Is it 110%? 130%? Keep your LTV at least 20% below that.

- Understand the interest. Is it fixed? Variable? Does it compound daily? Some platforms charge interest daily, which adds up fast.

Most platforms require a minimum collateral of $1,000 to $5,000. Onboarding takes 2 to 3 hours for CeFi platforms. For DeFi? Plan for 10 to 15 hours of learning. Wallet setup, gas fees, transaction confirmations-it’s not as simple as clicking ‘Apply’.

The Future of Crypto Borrowing

After the 2022 crash, the market shrank from $25.7 billion in loans to $14.2 billion. But it’s rebounding. By 2027, Gartner predicts traditional banks will control 60% of the market. Why? Because they’re safer. More regulated. Less likely to collapse.New developments are emerging too. Platforms like Centrifuge are now letting users back loans with real-world assets-like invoices or property deeds-using crypto as collateral. That’s the next phase: bridging crypto finance with traditional finance.

The bottom line? Crypto borrowing is powerful, but it’s not risk-free. It’s a tool. Use it like one. Don’t treat it like free money. And never forget: if you don’t understand how the liquidation system works, you’re one market drop away from losing everything.

Can I borrow crypto instead of fiat currency?

Yes. Some platforms, especially DeFi protocols like Aave and Compound, let you borrow stablecoins like USDC or DAI against your Bitcoin or Ethereum. This is useful if you want to stay in crypto but need liquidity to buy another asset. You can even borrow one cryptocurrency to buy another-like using ETH to borrow BTC.

What happens if I can’t repay the loan?

If you don’t repay or add more collateral, the platform will automatically sell your crypto to cover the loan. This is called liquidation. You won’t get a second chance. Once it’s sold, you lose that asset. Some platforms will refund any leftover value after the loan is paid off, but many don’t-especially during fast market crashes.

Is crypto borrowing safe?

It depends. DeFi loans are technically secure because they run on blockchain code-but code can have bugs. CeFi platforms are convenient but carry counterparty risk: if the company goes bankrupt, your assets may be frozen or lost. Traditional banks are safest but have strict rules and low borrowing limits. No option is 100% safe. The key is knowing the risks before you start.

Do I need to pay taxes on a crypto-backed loan?

In most countries, no. Borrowing against crypto doesn’t count as a sale, so you don’t owe capital gains tax. But if you later sell the borrowed fiat or crypto, you might owe taxes on that transaction. Always check your local tax laws. In the U.S., the IRS doesn’t tax loans-only realized gains.

Can I use any cryptocurrency as collateral?

Most platforms only accept Bitcoin and Ethereum because they’re the most liquid and stable. Some also accept Solana, Cardano, or Polygon. Stablecoins like USDC are rarely accepted as collateral because they don’t have price upside-you’d be better off just holding them. Always check what assets your chosen platform supports before depositing.

Why did so many crypto lenders fail in 2022?

Many CeFi platforms offered high interest rates to attract deposits, then lent that money out at lower rates to hedge funds or other borrowers. When crypto prices crashed, borrowers defaulted. The platforms didn’t have enough reserves to cover withdrawals. Celsius, Voyager, and BlockFi all used risky practices like lending to the same hedge funds repeatedly. When those hedge funds lost money, the lenders collapsed.

Write a comment